Werner07.OtherExpenses

Reading: BASIC RATEMAKING, Fifth Edition, May 2016, Geoff Werner, FCAS, MAAA & Claudine Modlin, FCAS, MAAA Willis Towers Watson

Chapter 7: Other Expenses and Profit

Contents

- 1 Pop Quiz

- 2 Study Tips

- 3 BattleTable

- 4 In Plain English!

- 4.1 Intro

- 4.2 A Simple Example

- 4.3 Underwriting Expense Categories

- 4.4 METHOD 1: All Variable Expense Method

- 4.5 METHOD 2: Premium-Based Projection Method

- 4.6 METHOD 3: Exposure-Based or Policy-Based Projection Method

- 4.7 Expense Projection Methods Concepts

- 4.8 Trending Expenses

- 4.9 Reinsurance Costs

- 4.10 Underwriting Profit Provision

- 4.11 Permissible Loss Ratios

- 4.12 More Exam Problems

- 5 POP QUIZ ANSWERS

Pop Quiz

What is the formula for the reported loss for a set of claims over a given time period such as a quarter or year? Click for Answer

Study Tips

VIDEO: W-07 (001) Loss & LAE → 4:30 Forum

Werner is well-written but I found chapter 7 to be a little wordy. There are 3 types of expense ratio methods you have to learn. In the previous chapter we looked at LAE (Loss Adjustment Expenses) and in this chapter we look at underwriting expenses. The goal here is to project an underwriting expense ratio for use in a ratemaking analysis. Depending on the method, the expense ratio may be split between fixed and variable expenses.

- Method 1: All Variable Expense Method

- Method 2: Premium-Based Projection Method ← this is the most frequently asked method

- Method 3: Exposure-Based (Policy-Based) Projection Method

(I find these easier than trending and on-leveling problems from previous chapters.)

There is also a brief introduction to calculating a premium rate, a topic that's covered in detail in Pricing - Chapter 8. Aside from the mechanics of each method, you also need to know their advantages and disadvantages.

Estimated study time: 3 days (not including subsequent review time)

BattleTable

Based on past exams, the main things you need to know (in rough order of importance) are:

- premium-based method - calculation and concepts

- expense provision - general questions (fixed vs. variable expenses, trending of expenses,...)

reference part (a) part (b) part (c) part (d) E (2019.Fall #6) reinsurance

- in ratemakingprofit provision

- investment incometrending

- necessary when...E (2019.Spring #6) total expense ratio

- all expenses variablevariable permissible LR:

- calculatedistortions

- due to expense ratiovariable permissible LR:

- calculateE (2018.Fall #6) premium-based method

- versus exposure-basedpremium-based method

- versus exposure-basedE (2018.Spring #7) Excel Practice Problems E (2017.Fall #7) premium-based method

- U/W expense ratiopremium-based method

- operating expense ratiototal permissible LR

- calculateWerner08.Indication 1 E (2017.Spring #2) Werner05.Premium variable expense ratio

- for U/W profit 5% 1Werner05.Premium Werner05.Premium E (2017.Spring #4) expense ratio

- C&B, generalpermissible LR

- calculate 2U/W profit provision < 0

- is profit possible?U/W profit expectations

- met / not metE (2016.Fall #6) expense provision

- actuary's approachexpense provision

- alternative approachE (2016.Spring #7) premium-based method

- indicated average rateachieve target profit

- without changing rates?E (2014.Fall #6) variable expense method

- indicated average ratepremium-based method

- indicated average rateexcessive or inadequate

- indicated average rateE (2013.Fall #7) premium-based method

- versus exposure-basedpremium-based method

- versus exposure-basedE (2013.Fall #12) pricing strategy

- evaluateE (2013.Spring #9) Werner08.Indication 1 expense provision

- fixed vs variableexpense provision

- fixed vs variable

- 2 There is an error in the examiner's report, although their final answer is correct. In their calculation, they write QT = +0.05 but it should be -0.05.

In Plain English!

Intro

Recall the Fundamental Insurance Equation:

- premium = (Losses + LAE + U/W Expenses) + U/W profit

Our goal in a ratemaking analysis is to estimate each of these components for the period when the proposed rates will be in effect. We learned how to do this for premium in Chapter 5 and for losses and LAE in Chapter 6. In this chapter, we're going to do the same thing for U/W Expenses and U/W profit. (We'll also take another quick look at how reinsurance fits into the big picture.)

A Simple Example

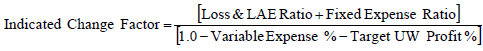

Click Notation - Pricing for a full list of the notation used in Werner. This example looks more complicated than it really is because of all the notation but once you get past that, it's just simple algebra. The notation we need in this section is as follows. Note that total exposures is denoted by X:

- P, P → Premium, Average premium (P divided by X)

- L, L → Losses, Pure Premium (L divided by X)

- EL, EL → Loss Adjustment Expense (LAE), Average LAE per exposure (EL divided by X)

- EF, EF → Fixed underwriting expenses, Average underwriting expense per exposure (EF divided by X)

For the above variables, the total dollar amount is listed first and the average dollar amount is listed second. The average amount equals the total amount divided by exposures X.

- V → Variable expense provision (EV divided by P)

- QT → Target profit percentage

This is going to be your very first rate indication. Use the Fundamental Insurance Equation to calculate the average premium the insurer must charge.

- L + EL = $180 (average Loss + LAE)

- EF = $20 (fixed U/W expenses)

- V = 15% (includes premium taxes and other things)

- QT = 5% (target profit percentage)

The target profit percentage is the compensation an insurer receives for taking on risk. In a bad year they would make less than 5%; in a good year, more. Over a longer time period, the average should be roughly 5%. (This doesn't include investment income.) We're going write the Fundamental Insurance Equation using this notation then solve for P. Note that in the last step, we divide both sides by X to switch from total dollar amounts to average dollar amounts.

Now just substitute the given values into the final formula:

- P = ($180 + $20) / (1.0 - 0.15 - 0.05) = $250

You can practice a slightly harder variation of this problem in the quiz.

Underwriting Expense Categories

Underwriting expenses are expenses incurred in the acquisition and servicing of policies. They are also referred to as operational and administrative expenses.

Question: what are the 4 categories of U/W expenses

- Commissions & Brokerage: payment to agents or brokers for generating business

- Other Acquisition: expenses for generating business, other Commissions and Brokerage

- Taxes, Licenses & Fees: all taxes and fees excluding federal income tax (Ex: premium taxes)

- General: all remaining expenses (Ex: building maintenance, salaries)

These expense categories can be further split into fixed expenses and variable expenses. Fixed expenses are the same for each risk. An simple example is the cost of an auto insurance policy form. It doesn't matter whether the premium is $300 or $800, the cost of the printed form is the same. Variable expenses are different for each risk and are expressed as a percentage of premium. An example is agents' commission which is typically 10-15% of written premium.

We're going to cover 3 methods for calculating the U/W expense term in the Fundamental Insurance Equation. The premium-based projection method appears most often on past exams.

METHOD 1: All Variable Expense Method

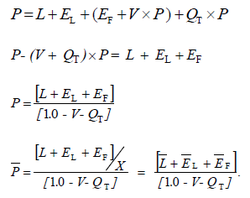

This first method assumes all 4 categories of expenses are variable and that they vary with premium. (Technically, a variable expense could vary with something other than premium, but the All-Variable method discussed here assumes all expenses vary with premium.) In the example below, you're given the expense ratios for calendar years 2023 and 2024 and the dollar amounts for 2025. You have to calculate the ratios for 2025 then use information from all 3 years to select an appropriate total expense ratio for a ratemaking analysis.

For example, the Commissions and Brokerage ratio for 2025 is 963/DWP = 963/9000 = 10.7%. It's an easy calculation but you have to be careful whether to use written or earned premium in the denominator. Commissions and brokerage expenses are incurred when the policy is written so it's logical to express them as a percentage of written premium. General expenses however (like building maintenance and salaries) are incurred over the policy term so we match them to premium earnings over that same time frame. Note that Other Acquisition and TLF are incurred at policy inception so we use written premium for those as shown in the solution below.

Here are 2 practice problems on this method:

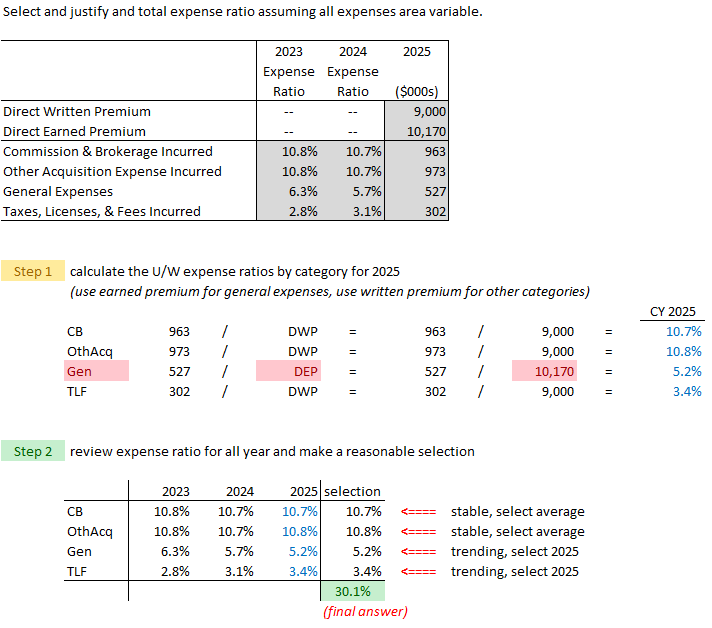

METHOD 2: Premium-Based Projection Method

The premium-based projection method is similar to method 1 but with one extra step. As before, divide the dollar amounts for each category by written or earned premium as appropriate to get total expense ratios. The extra step is then to separate those ratios into their fixed and variable components using the % fixed values that are given. (These percentages would have been produced by a separate study, although the % fixed for commissions is virtually always 0%.) For me, the key to solving it correctly is being extra careful about organizing my table. There are a lot of percentages floating around and it's easy to get mixed up. Every exam problem is a little different but insofar as is possible try to organize your solution essentially the same way every time.

Here are 2 practice problems:

And here's a quiz with a web-based version of the premium-based projection method. This has been the most frequently asked calculation problem from this chapter.

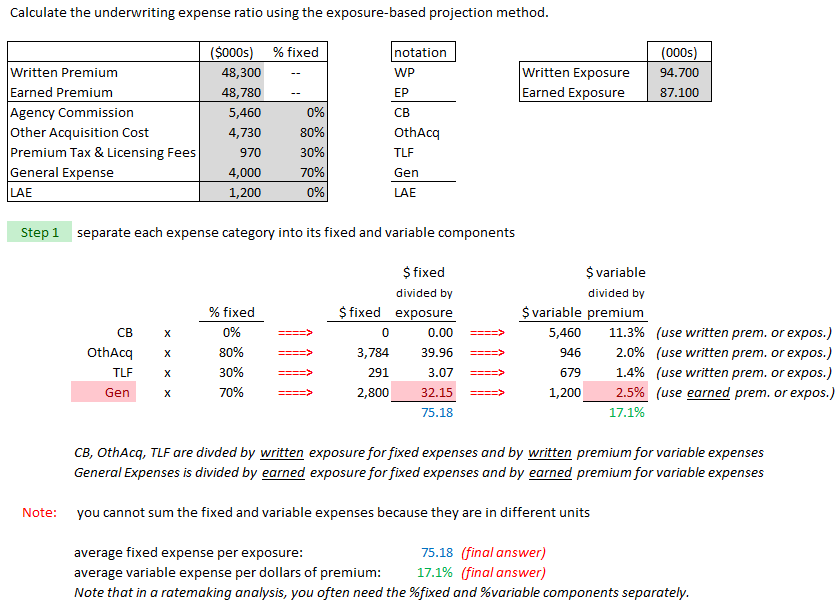

METHOD 3: Exposure-Based or Policy-Based Projection Method

The exposure-based projection method builds on the premium-based projection method discussed above. If you compare methods, you'll see in the example further down there are 2 differences:

- expense dollars are split into fixed and variable components before dividing

- dollar-values for the fixed component are divided by exposures instead of premiums

The exposure-based method addresses a problem with the premium-based method of fixed expenses being over-stated (under-stated) when premiums are growing (shrinking). We'll cover this in more detail in the section on Expense Projection Methods Concepts.

Ian-the-Intern asked why we even bother with the first 2 methods if the exposure-based method is more accurate. Well, the exposure-based method requires exposure data, which may not always be readily available or reliable. And even if the exposure-based method is theoretically more accurate, it may not always be so in practice. For many years, actuaries used the 'All Variable' method and there is debate over whether this is even a material improvement on that. Remember that more complex methods introduce more possibilities for errors. In both the exposure and premium-based methods, the results are dependent on the %fixed and %variable parameters and these are generally selected judgmentally. If the percentages aren't accurate then the final results may actually be worse than the simpler 'All Variable' method.

Here are 2 practice problems...

Expense Projection Methods Concepts

Now that you know how these expense projection methods work, let's take a step back and discuss some of the background concepts.

Methods 1 and 2 involve expense ratios relative to premium, and we already talked about when to use written premium versus earned premium. Recall expenses such as agent commissions are divided by written premium because commissions are incurred when a policy is written. The same is true for other acquisition costs and TLFs (Taxes, Licenses, and Fees). In contrast, general expenses such as building maintenance and salaries are divided by earned premium because those expenses are incurred gradually over the policy term. This provides a better match between expenses incurred and premiums earned.

In the exposure-based method, we divided fixed expenses by exposures to calculate an average premium rather than an expense ratio. The choice of whether to use written or earned exposure in that calculation followed the same reasoning as with premiums. General expenses are divided by earned exposure; the other expense categories, by written exposure.

Something that did not come up in our examples is whether to use state or countrywide expense data. You might think state-level data would be preferable but state-level data may not always be credible or readily available. Commissions and TLFs generally vary by state so we should use state-level data for those if it's available, but other acquisition costs and general expenses are often assumed to be uniform across all states so we can use countrywide data for those.

Regarding the treatment of expenses as fixed or variable we can usually assume commissions and brokerage are variable. This is usually in the 8-15% range depending on various factors. Other acquisition costs and general expenses are a mixture of fixed and variable expenses. This is reflected in the example problem where other acquisition costs were assumed to be 80% fixed and 20% variable. The specific percentages depend on company characteristics. TLFs are tricky however because T (Taxes) are usually variable but LFs (Licenses & Fees) are usually a fixed amount per policy.

All of this information can be summarized in a table:

Expense Data Used Divided By Fixed or Variable Commission & Brokerage state or countrywide written premium or exposure variable Other Acquisition Cost countrywide written premium or exposure mixture TLFs state written premium or exposure T is variable, LF is fixed General Expense countrywide earned premium or exposure mixture

Let's now take a quick look at the advantages and disadvantages of each method.

Question: identify advantages and disadvantages of the All Variable Expense Method

- advantages: easy to apply, don't need to know % fixed versus % variable

- disadvantages: underestimates (fixed) expenses for low-dollar risk and overestimates for high-dollar risks

- (Ex: a 5% License & Fee ratio is $5 on a $100 policy but $50 for a $1,000 policy even if the License & Fee is a fixed amount of $20 per policy)

Question: identify advantages and disadvantages of the Premium-Based Expense Method

- advantages: more accurate than 'all variable' method because fixed and variable expenses are treated separately

- disadvantages:

- - assumes historical expense ratios are the same as in the projected period

- - using countrywide data can skew true state-level expenses

- - requires judgment for percentage split between fixed and variable expenses

- Before continuing, let's examine the assumption that historical expense ratios are the same as in the projected period. Why is this assumption even a problem? Well, if it doesn't hold it can cause distortions in fixed expenses. There are 2 ways this can happen:

- First, due to rate changes: Fixed expenses are measured against premium so if premium increases, possibly due to normal rate increases over time, the fixed expense ratio should go down. (A $20 fee against $100 of historical premium is an expense ratio of 20% but against a future premium of $110 its only 18.1%) If this isn't recognized, and the unadjusted expense ratio is used then fixed expenses will be overstated. Similarly, if rates had decreased since the historical period then fixed expenses will be understated. Fortunately this problem can be addressed by first expressing historical premium at current rate level as done in Pricing - Chapter 5.

- Second, due to changes in average premium: A distributional shift in the book of business leading to a higher average premium will cause fixed expenses to be overstated. (That flat fee of $20 is going to be overestimated if it's calculated as the same percentage of a higher average premium.) Similarly, a decrease in average premium will cause fixed expenses to be understated. Using a 3-year average to derive expense ratios can make this worse because there's more likely to be a change in average premium over a 3-year historical period versus a 1-year period. Fortunately this problem can be addressed by trending historical premium to projected levels as was done in Pricing - Chapter 5.

- The other disadvantage of the premium-based method concerns the use of countrywide data for the fixed expense ratio. States may differ widely in average premium so using the same fixed expense ratio across all states will result in higher fixed expenses for high average premium states and lower fixed expenses for low average premium states. While it may be true that high average premium states have higher fixed expenses, a fixed expense ratio based on premium is a blunt instrument and likely skews fixed expenses that are more related to number of policies written rather than average premium. The exposure-based projection method tackles this problem.

Question: identify advantages and disadvantages of the Exposure-Based Expense Method

- advantages: more accurate than the premium-based method because fixed expenses are measured against exposures rather than premiums

- disadvantages:

- - requires judgment for percentage split between fixed and variable expenses

- - using countrywide data can skew true state-level expenses

- - some expenses treated as fixed are actually variable by certain characteristics (Ex: by new versus renewal business)

- - economies of scale may reduce fixed expenses but this is not captured in the method

For the example problems in previous sections, we selected final expense ratios judgmentally. If the ratios appear stable over a 3-year period, we might choose a 3-year average. If there is a clear trend up or down, a 1-year or 2-year average might be more reflective of the changing conditions. Aside the raw data, the actuary should consult with management regarding operational changes that may be driving changes in expenses. This could include underwriting criteria, staffing levels, premium growth, and anything else that could directly or indirectly affect the level of expenses.

Trending Expenses

This section in the text looks more complicated than it really is. It all boils down to just a few facts you have to memorize (and of course understand):

Question: identify when expenses need to be trended

- fixed & variable expenses measured against premium where the expense trend is different from the premium trend

- fixed expenses measured against a non-inflation-sensitive exposure base

Question: identify when expenses do not need to be trended

- fixed & variable expenses measured against premium where the expense trend is equal to the premium trend

- (because expenses will change automatically when premium changes)

- fixed and variable expenses measured against an inflation-sensitive exposure base where the expense trend is equal to the exposure trend

- (because expenses will change automatically when exposure base changes)

Now that we know when expenses should be trended, how are we going to do it?

Question: if expenses do need to be trended, what is the trend period

- from the midpoint of the historical period to either AWD or AED of the prospective period

- → use AWD for categories of expenses incurred when policy is written

- → use AED for categories of expenses incurred over policy term (usually just general expenses)

Question: how can an expense trend be selected

- internal company data (but internal expense data is often too volatile)

- government indices such as CPI (Consumer Price Index)

Reinsurance Costs

This section is very simple and you only have to know a couple of things:

- Proportional reinsurance (quota-share reinsurance) does not need to be accounted for in a rate analysis because premium and losses are ceded to the reinsurer in equal proportions.

- Non-proportional reinsurance does need to be accounted for and there are 2 options:

- → primary insurer reduces both losses and premium by the amounts ceded (or expected to be ceded) to the reinsurer

- → primary insurer includes an expense equal to (ceded premium) – (expected ceded losses)

Underwriting Profit Provision

When an insurer issues a policy they assume risk and must maintain capital to support that risk. The compensation for assuming this risk and bearing the cost of capital is a reasonable profit margin in their rates. The specific margin depends on the level of risk but for a lower risk line of business like auto insurance, a underwriting profit margin of 5% is considered reasonable. The margin is the difference between the premium charged and the sum of losses and expenses. You can rearrange the Fundamental Insurance Equation to solve for U/W profit:

- U/W profit = premium – (Losses + LAE + U/W Expenses)

But that isn't the only way an insurer makes a profit. Total profit has 2 components:

- Total Profit = Investment Income + U/W Profit.

Investment income can be earned by:

- earnings on invested capital

- earnings on policyholder supplied funds (loss reserves and unearned premiums)

Investment income is not included in a rate analysis but it can be a significant source of income for long-tailed lines where loss reserves are held by the insurer for an extended period.

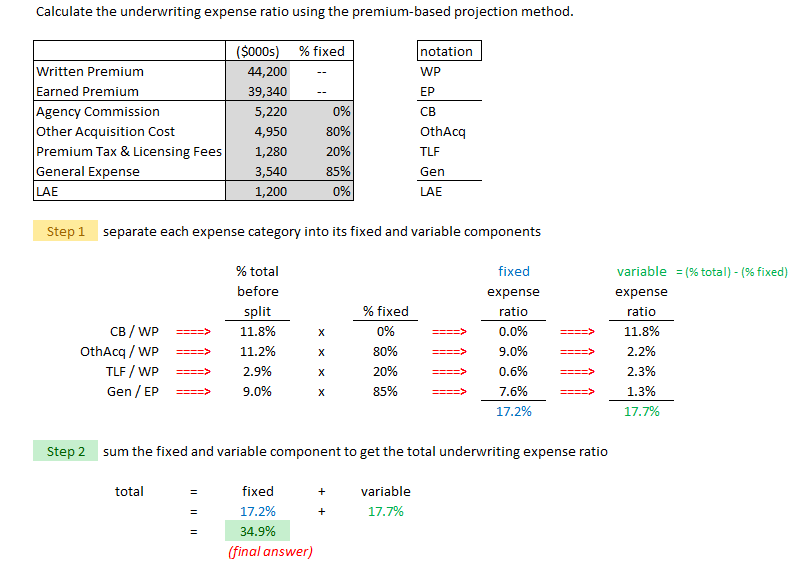

Permissible Loss Ratios

When you do the exam problems from the chapter, you'll see they sometimes ask you to calculate one of both of these quantities:

- Variable Permissible Loss Ratio = VPLR = 1.0 – V – QT

- Total Permissible Loss Ratio = PLR = 1.0 – F – V – QT

You might wonder why the Total Permissible Loss Ratio is abbreviated by PLR instead of TPLR. I don't know so I asked Alice. She doesn't know either. Anyway, the interpretation is as follows:

- VPLR is the percentage of each premium dollar that is intended to pay for the projected loss and LAE and projected fixed expenses

- PLR is the percentage of each premium dollar that is intended to pay for the projected loss and LAE

You can understand the VPLR interpretation by rearranging the formula for P that we covered in A Simple Example at the beginning of this wiki article:

- P = (L + EL + EF) / (1.0 – V – QT)

is equivalent to

- P x (1.0 – V – QT) = (L + EL + EF)

The left side represents the VPLR% of premium P and the right side represents loss + LAE + fixed costs.

More Exam Problems

Mostly calculation problems...

Mostly concept problems but 1 'All Variable' method calculation problem...

POP QUIZ ANSWERS

For a set of claims over a given time period such as a calendar year:

- → CY reported loss = (CY paid loss) + (change in case reserve)

(The change in case reserve is the ending reserve minus the beginning reserve.)

And recall that for an individual claim at any given point in time:

- → reported loss = (paid loss) + (case reserve)