Werner08.Indication

Reading: BASIC RATEMAKING, Fifth Edition, May 2016, Geoff Werner, FCAS, MAAA & Claudine Modlin, FCAS, MAAA Willis Towers Watson

Chapter 8: Overall Indication

Contents

Pop Quiz

What is the formula for the pure premium method for calculating an average rate? Click for Answer

Study Tips

VIDEO: W-08 (001) Overall Indications → 6:00 Forum

Franklin has a tip to brighten your day! There is very little new material in chapter 8. You did all the hard work in earlier chapters and chapter 8 just ties everything together into an overall rate indication. There are 2 basic formulas:

• pure premium formula (we actually already covered this here in chapter 7.)

• loss ratio formula (provides the change in rates rather than a specific dollar-value as in the pure premium formula)

You'll need to know where each method can and can't be used but that's easy. Most of your time will be spent doing practice problems. The source text also shows how each formula is derived starting with the Fundamental Insurance Equation but I believe this is outdated for an Excel-based exam. (Some very old exam problems asked you to reproduce these derivations but this isn't feasible in Excel.)

Estimated study time: 3 days (not including subsequent review time)

BattleTable

Based on past exams, the main things you need to know (in rough order of importance) are:

- loss ratio method - calculating an indicated rate change

- pure premium method - calculating an indicated rate

- miscellaneous information - situations where each method is appropriate and where it isn't

reference part (a) part (b) part (c) part (d) E (2019.Fall #7) loss ratio method

- with BF methodE (2019.Spring #7) ultimate L+LAE

- with BF methodWerner12.Credibility Werner12.Credibility E (2018.Fall #7) reinsurance cost

- 12 month termultimate L+LAE

- with Freq/Sev methodprojected pure premium

- all yearspure premium method

- new rate & rate changeE (2017.Fall #15) ultimate L+LAE

- with development methodultimate L+LAE

- with BF methodultimate L+LAE

- make final selectionloss ratio method

- assume full credibilityE (2017.Spring #5) loss ratio method

- rate changepure premium method

- new rateinappropriate uses for:

- LR method, PP methodE (2017.Spring #13) ultimate loss

- capped at 100Kloss ratio method

- assume full credibilitynot taking full change

- reasons forE (2016.Fall #7) U/W profit provision

- for each companyU/W profit provision

- reasons for variationsE (2016.Fall #8) loss ratio method

- assume full credibilityE (2016.Fall #9) loss ratio method

- assume full credibilityE (2016.Spring #1) on-level loss ratio

- rate & benefit changesE (2016.Spring #6) using credibility

- rate changeprofit provision

- negative valuecompare methods:

- pure premium vs loss ratioE (2016.Spring #8) loss ratio method or

pure premium methodE (2015.Spring #9) pure premium method

- new rateE (2014.Fall #7) pure premium method

- new rateE (2014.Spring #5) loss ratio method

- assume full credibilitycomplement of credibility

- assess appropriatenessE (2013.Fall #4) loss ratio method

- with 2-step trendingEP @ CRL:

- alternative methodsimpact on indication:

- uniform premium earningE (2013.Spring #3) recommend improvements:

- to rate indicationE (2013.Spring #5) loss ratio method

- assume full credibility

Full BattleQuiz You must be logged in or this will not work.

In Plain English!

Intro

Alice gave Ian-the-Intern this quiz when he arrived at work, and he got the right answer on only his second try. Exactly one of the following statements is true. Can you tell Alice which one it is?

- The goal of ratemaking is to set rates too low so that premium charged does not cover losses & expenses. The losses can then be written off the company's corporate taxes.

- The goal of ratemaking is to set rates too HIGH so that premium charged greatly exceeds losses & expenses and generates a huge profit. We can then finally get that espresso maker for the break room.

- The goal of a ratemaking analysis is to set rates so that premium charged covers losses & expenses and achieves the targeted profit for policies written during a future period

The correct answer is #3. Memorize it. It's just another way of saying the Fundamental Insurance Equation should be balanced. (Ian's first guess was #2 because he desperately needs his caffeine fix when he gets to work in the morning.)

Pure Premium Method

We covered the pure premium method here in chapter 7, and the first quiz in that section had a web-based problem for practice. You can review it briefly if necessary. The mathematical derivation of the formula was provided but I don't believe you'll be tested on that. I included it so you could see how the rate indication formula follows from the Fundamental Insurance Equation. Mini Battle-Quiz #1 below has a web-based infinite calculation problem which is a harder version of the pure premium method.

Note that the pure premium method requires exposure data, and gives you the dollar-value of the indicated rate. The loss ratio method discussed in the next section works a little differently. The loss ratio method requires premium data, and gives you the percent change from the previous rate.

Loss Ratio Method

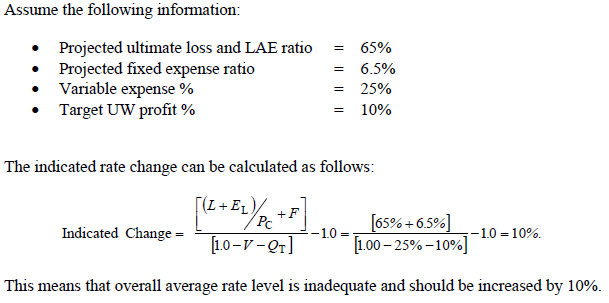

The source text does a nice job of explaining the loss ratio method in a simple way. Here's the formula:

Remember you can always use the link in the sidebar under Miscellaneous Battle Reports to review pricing notation. (You might have to scroll up to see the sidebar links.) Or use the direct link Notation - Pricing. But just to save you a little time, here's the notation used in the above formula:

- L → Losses

- EL → Loss Adjustment Expense (LAE)

- Pc → Premium at current rates

- F → Fixed U/W Expense ratio

- V → Variable Expense Provision

- QT → Target profit percentage

The text provides a nice simple example to show you how the formula works. Note they don't actually provide the values for L, EL, Pc. Instead they give you (L + EL)/Pc directly, which you can just toss into the numerator. They saved you like 5 seconds. :-)

Remember the key difference between the pure premium method and loss ratio method: The pure premium method gives you the dollar-value of the indicated rate whereas the loss ratio method gives the percent change from the previous rate. If you think about that for a moment, you'll see that the loss ratio method cannot be used for a brand new line of business because a new line of business wouldn't have a previous rate. In that scenario, you would have to use the pure premium method.

The source text also shows how the loss ratio formula is derived starting with the Fundamental Insurance Equation, and that it's algebraically equivalent to the pure premium method. That means if you have the necessary input data, both methods should give the same result. (If you have both the indicated rate from the pure premium method as well as the prior rate, you can calculate the rate change and compare it to the result from the loss ratio method.) The quiz has slightly harder version of this example for practice.

ULAE Provision

The ULAE Provision is a quantity that appears in many rate indication problems and it's a very simple concept. It's generally expressed as follows:

- ULAE provision = x% of loss & ALAE

The percentage might typically be in the 5-8% range. The way to incorporate this into your solution is by multiplying ultimate trended loss & ALAE by (1 + x%). As an extremely simple example, suppose you have:

ultimate loss & ALAE for AY 2020 4711 trend factor to bring AY 2020 to the effective period (1.04)4.5 ULAE provision 7% of loss & ALAE

Then the ultimate trended loss and LAE (including both ALAE & ULAE) = 4711 x (1.04)4.5 x 1.07 = 6014.

(Sometimes the ALAE provision is expressed as a ratio in a similar way.)

Credibility

Credibility is discussed in detail in Chapter 12 - Credibility. For problems in this chapter, you're often told simply to assume full credibility. If so, you don't have to do anything special – just use the data as given. If you're told the data is not fully credible, you most likely need something called a complement of credibility and you'll have to return to the problem after covering Chapter 12 - Credibility.

As an example, part (a) of the following problem requires you to calculate credibility then use a complement of credibility to calculate the indicated rate change. It's a very easy problem and you can probably figure it out just by looking at the solution even if you haven't covered the credibility chapter yet. The credibility-weighted indication is a weighted average of:

- the rate change calculated using company data

- the given countrywide indicated rate change

The weights come from the square root formula for credibility.

- E (2016.Spring #6)

Exam: 2019.Fall #7

Let's start with the most recently available exam problem. Below is the link to the problem and solution and I'd suggest either printing or opening it in a separate tab so you can follow along with Alice's explanation.

- E (2019.Fall #7)

It may not seem like it at first but these rate change problems all follow a similar pattern. When you look at the problem, you have to "see" the information as it falls into the categories listed below. Take a moment to make sure you can do this. Note that this problem asks for the indicated rate change and that's usually a clue to use the loss ratio method. (If the problem had provided exposures then that would be a clue to use the pure premium method instead.)

- general rate change information

- - effective date, policy term, period that rates are expected to be in effect

- losses and LAE

- raw data, loss trends, ULAE percentage (ALAE is often just included with losses)

- counts

- - most problems do not provide count information

- premiums

- - EP, WP, EE, WE, historical rate changes

- expenses:

- - V, QT, F, EF , PLR

- - C&B, OthAcq, TLF, Gen, %fixed

- miscellaneous information

- - sometimes there's a trick or sometimes you're given the information in a slightly different way

- - you have to recognize when you're given something "weird" and figure out how to incorporate it into your solution

This problem is actually pretty straightforward provided you stay organized. After you've wrapped you head around the given data, you should write down the loss ratio formula on your scrap paper. This will help you keep track of what you're doing. Even though your submitted solution is entirely in Excel, it will very helpful to use pen and paper for certain steps like calculating trend periods for losses and premiums and doing the current rate level calculations for premiums.

You're now ready to start calculating and here is a step-by-step guide. I'm going to assume you can do the details of each step. You can refer to the examiner's report for assistance.

- Step 1: calculate trended ultimate (L + EL) using the Bornhuetter-Ferguson method (you'll need to calculate development factors as well as the loss trend period here)

- Step 2: calculate trended, on-level EP (you'll need CRL factors and the premium trend period here)

At this point, you have the first half of the numerator. Here's the other piece of the numerator:

- Step 3: calculate F for each CY separately (recall F = EF / Pc where EF is fixed expenses)

And finally, the denominator of the loss ratio formula:

- Step 4: substitute everything into the rate change formula (you were given V and QT directly so the denominator is easy)

Note the "weird" piece of information given here: In 2017, the company implemented a new policy issuance system. So where does that fit in? Well, you probably noticed that the fixed expenses for 2017 were much higher than for 2016 and 2018. This was due to the new issuance system and is likely a one-time charge. That means 2017 should be excluded when calculating an overall value for F. The examiner's report says a common error was including 2017. This would make the fixed expense ratio F too high which in turn would make the indicated rate change too high and you would probably lose customers.

Alice's Pro Tip: Pay attention to all the given information!

| Pop Quiz A! :-o |

- There was one other "weird" piece of information in this problem. What was it? Click for Answer

Exam: 2017.Spring #13

Let's try the same sort of analysis with another problem:

E (2017.Spring #13)

First we have to organize the information:

- general rate change information - this is provided in the long list of bullet points under the data tables and in the statement of the question for part (b)

- → effective date: July 1, 2017

- → policy term: annual

- → rates in effect for: 1 year

- losses & LAE

- → 3rd and 4th tables show reported losses (capped at 100K), and excess loss information

- → loss trends (frequency and severity) and ULAE provision are shown in the bullet points

- counts - no count information provided

- premiums

- → the 1st and 2nd tables show EP and rate changes (use this to calculate EP @ CRL)

- → premium trend is shown in the bullet points

- expenses

- → F, V, QT are shown in the bullet points

- miscellaneous information

- → capped losses and excess loss information

The "weird" information in this problem is the excess loss information. We covered how to calculate Excess Loss Factors in chapter 6. You can review that material and the associated web-based practice problem if necessary. The calculation in the above exam problem is actually easier than the version of the excess loss factor problem in chapter 6. Just as a reminder, here's the basic formula:

- excess loss factor = (excess losses) / (non-excess losses)

Note that "non-excess losses" is the same thing as "capped losses".

So give the problem a try. Remember to write down on your scrap paper the formula for the indicated rate change. Then just methodically calculate each component of that formula.

Remaining Exam Problems

You should make sure you understand the 2 problems discussed above then try a few more from the quizzes. Since this has traditionally been the most heavily tested topic across the whole Exam 5 syllabus it will helpful to return to it from time to time. By exam day I recommend you have completed all the old exam problems multiple times. Note that some of these problems have a step that uses material we haven't covered yet but don't worry too much about that. When this happens, make a note and return to it later. It's sometimes hard to assign these exam rate indication problems to specific chapters because they cover material from many different chapters.

A selection of problems using the loss ratio method:

A selection of problems using the pure premium method:

A few miscellaneous problems:

Full BattleQuiz You must be logged in or this will not work.

POP QUIZ ANSWERS

Pure Premium method formula for average rate: P = (L + EL + EF) / (1.0 – V – QT)

Pop Quiz A - Answer

The other piece of "weird" information in this problem was the 36-ultimate tail factor. The examiner's report mentioned that forgetting to use it was another common mistake. The given reported loss triangle only has 3 AYs and there is almost almost always development past 36 months. Without using the tail factor, your ultimate losses would be too low which means your indicated rate change would also be too low. Since you're now underpriced, you would probably see lots of growth in exposures! Unfortunately it would all be unprofitable. :-(