WernerB.Home

Reading: BASIC RATEMAKING, Fifth Edition, May 2016, Geoff Werner, FCAS, MAAA & Claudine Modlin, FCAS, MAAA Willis Towers Watson

Appendix B: Homeowners Indication

Pop Quiz

Study Tips

| Alice's Mega-Pro-Tip: Appendix B is an example of a Pure Premium Indication but it contains new material not covered in the main chapters of Werner. |

Forum Unfortunately, Appendix B contains new material and you will have to spend considerable time studying this problem type.

The ranking table lists this reading as Rarely Asked but that's because it has not appeared on an exam since 2015. Note however that the 2015 question was worth 4.5 points. That would be a giant hit on your score if you were to miss it completely. I'm tempted to think that the CAS has decided this type of problem is no longer important but there is no way to know for sure. If you are really pressed for time, you could skip this appendix, or at least memorize the 5 components. (See further down for what these are.)

This wiki article provides examples of how to lay out your solution in a step-by-step way. Once you've done the practice problems you can try the old exam problems. If you get stuck, you can also refer to Appendix B in Werner for the full HO indication example.

Estimated study time: 2 days (not including subsequent review time)

BattleTable

Based on past exams, the main things you need to know (in rough order of importance) are:

- how to do a pure premium homeowners indication - includes a catastrophe component and an AIY component (Amount of Insurance Years)

reference part (a) part (b) part (c) part (d) E (2015.Fall #7) ultimate loss

- calculatePP method

- calculate rate changeE (2014.Fall #5) PP method:

- loss & LAE provisionE (2013.Fall #8) PP method

- calculate rate change

In Plain English!

The overall goal in this type of homeowners indication is to calculate a total pure premium amount and there are 5 components:

- projected ultimate non-cat pure premium

- projected non-modeled cat pure premium

- projected modeled cat pure premium

- projected net reinsurance pure premium

- projected fixed expense pure premium

The final answer is the sum of these components divided by the VPLR or Variable Permissible Loss Ratio. Now, you already know how to calculate some of these components so even if you didn't study this appendix you could probably get some partial credit. The new concepts are:

- non-modeled cat-to-AIY ratio

- AIY / EE ratio

AIY (in $000s) is Amount-of-Insurance years for each calendar year. It represents the sum total of amount of insurance for all policies in-force during the calendar year. The reason for introducing the concept of AIY is, according to Werner:

- If the non-modeled catastrophe pure premium was based on the ratio of non-modeled catastrophe losses and ALAE to house years, the ratio would increase over time due to the influence of inflation and other factors on the numerator during the twenty year period. Using AIY in the denominator is a simple way to adjust the ratio for inflation.

You can refer to the Werner source text for further explanation and a different example, but I think you might get more out of Alice's example below since it's laid out as a step-by-step method.

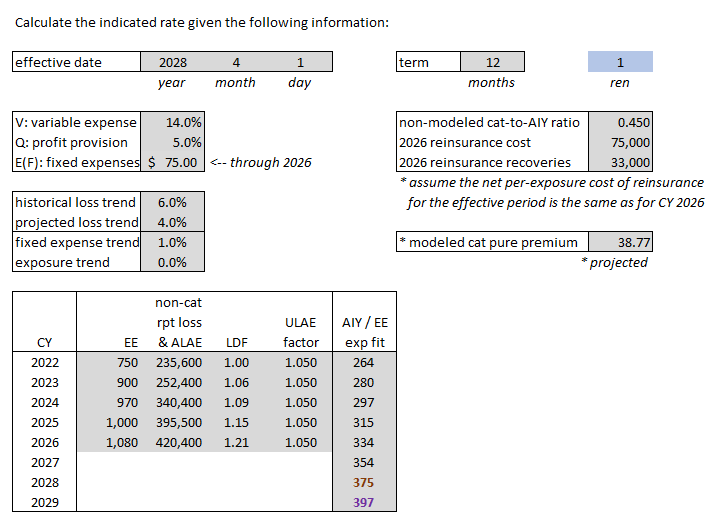

| Here's the statement of the problem: |

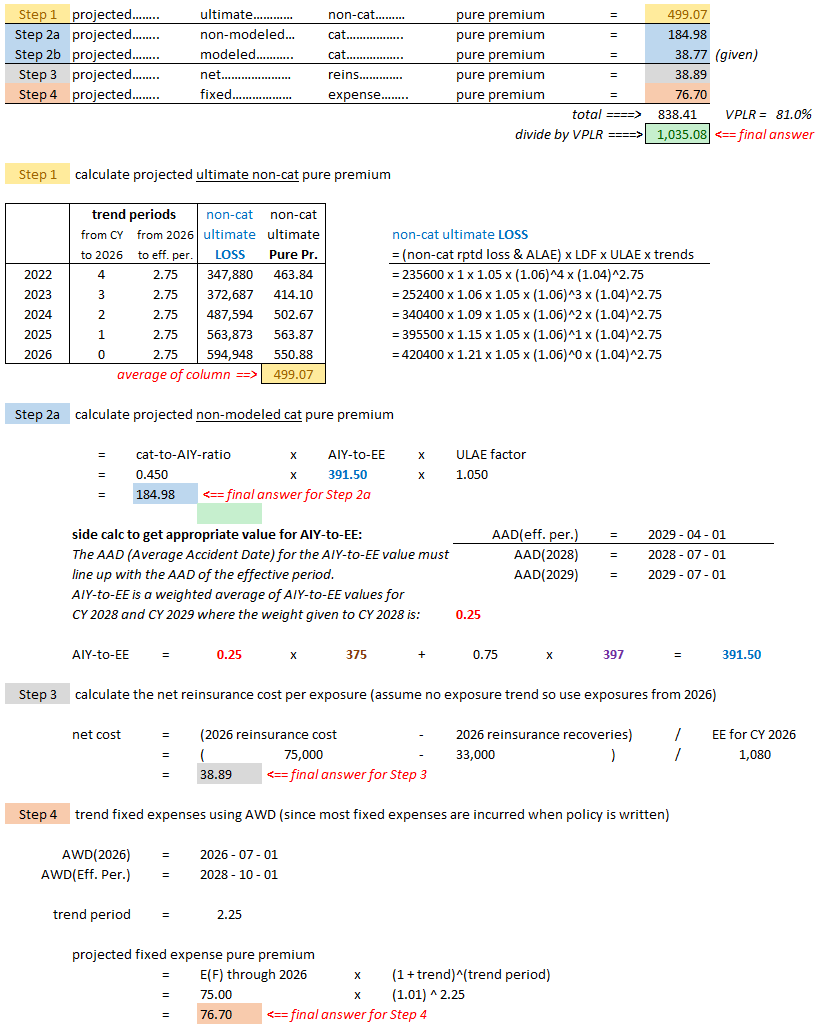

| And here's the solution: (shout-out to k1996!) |

| And here are 2 more practice problems: |

The quiz just has the old exam problems...