Difference between revisions of "Werner07.OtherExpenses"

(→BattleTable) |

|||

| Line 1: | Line 1: | ||

| + | '''Reading''': BASIC RATEMAKING, Fifth Edition, May 2016, Geoff Werner, FCAS, MAAA & Claudine Modlin, FCAS, MAAA | ||

| + | Willis Towers Watson | ||

| + | '''Chapter 7''': Other Expenses and Profit | ||

==Pop Quiz== | ==Pop Quiz== | ||

| − | == | + | ==Study Tips== |

==BattleTable== | ==BattleTable== | ||

| Line 19: | Line 22: | ||

|- | |- | ||

| + | || [https://www.battleacts5.ca/pdf/Exam_(2019_2-Fall)/(2019_2-Fall)_(06).pdf <span style='font-size: 12px; background-color: yellow; border: solid; border-width: 1px; border-radius: 5px; padding: 2px 5px 2px 5px; margin: 5px;'>E</span>] <span style="color: red;">'''(2019.Fall #6)'''</span> | ||

| + | || [[Werner06.LossLAE]] | ||

| + | || '''profit provision''' <br> - investment income | ||

| + | || '''trending''' <br> - necessary when... | ||

| + | | style="background-color: lightgrey;" | | ||

| + | |||

| + | |- style="border-bottom: solid 2px;" | ||

| + | || [https://www.battleacts5.ca/pdf/Exam_(2019_1-Spring)/(2019_1-Spring)_(06).pdf <span style='font-size: 12px; background-color: yellow; border: solid; border-width: 1px; border-radius: 5px; padding: 2px 5px 2px 5px; margin: 5px;'>E</span>] <span style="color: red;">'''(2019.Spring #6)'''</span> | ||

| + | || '''total expense ratio''' <br> - all expenses variable | ||

| + | || '''variable permissible LR''': <br> - calculate | ||

| + | || '''distortions''' <br> - due to expense ratio | ||

| + | || '''variable permissible LR''': <br> - calculate | ||

| + | |||

| + | |- | ||

| + | || [https://www.battleacts5.ca/pdf/Exam_(2018_2-Fall)/(2018_2-Fall)_(06).pdf <span style='font-size: 12px; background-color: yellow; border: solid; border-width: 1px; border-radius: 5px; padding: 2px 5px 2px 5px; margin: 5px;'>E</span>] <span style="color: red;">'''(2018.Fall #6)'''</span> | ||

| + | || '''premium-based method''' <br> - versus exposure-based | ||

| + | || '''premium-based method''' <br> - versus exposure-based | ||

| + | | style="background-color: lightgrey;" | | ||

| + | | style="background-color: lightgrey;" | | ||

| + | |||

| + | |- style="border-bottom: solid 2px;" | ||

|| [https://www.battleacts5.ca/pdf/Exam_(2018_1-Spring)/(2018_1-Spring)_(07).pdf <span style='font-size: 12px; background-color: yellow; border: solid; border-width: 1px; border-radius: 5px; padding: 2px 5px 2px 5px; margin: 5px;'>E</span>] <span style='color: red;'>'''(2018.Spring #7)'''</span> | || [https://www.battleacts5.ca/pdf/Exam_(2018_1-Spring)/(2018_1-Spring)_(07).pdf <span style='font-size: 12px; background-color: yellow; border: solid; border-width: 1px; border-radius: 5px; padding: 2px 5px 2px 5px; margin: 5px;'>E</span>] <span style='color: red;'>'''(2018.Spring #7)'''</span> | ||

|| [[Excel Practice Problems]] | || [[Excel Practice Problems]] | ||

| Line 27: | Line 51: | ||

|- | |- | ||

|| [https://www.battleacts5.ca/pdf/Exam_(2017_2-Fall)/(2017_2-Fall)_(07).pdf <span style='font-size: 12px; background-color: yellow; border: solid; border-width: 1px; border-radius: 5px; padding: 2px 5px 2px 5px; margin: 5px;'>E</span>] <span style='color: red;'>'''(2017.Fall #7)'''</span> | || [https://www.battleacts5.ca/pdf/Exam_(2017_2-Fall)/(2017_2-Fall)_(07).pdf <span style='font-size: 12px; background-color: yellow; border: solid; border-width: 1px; border-radius: 5px; padding: 2px 5px 2px 5px; margin: 5px;'>E</span>] <span style='color: red;'>'''(2017.Fall #7)'''</span> | ||

| − | || | + | || '''premium-based method''' <br> - U/W expense ratio |

| − | || | + | || '''premium-based method''' <br> - operating expense ratio |

| − | || | + | || '''total permissible LR''' <br> - calculate |

| − | || | + | || [[Werner08.Indication]] <span style="color: red;"><sup>'''1'''</sup> |

| + | |||

| + | |- | ||

| + | || [https://www.battleacts5.ca/pdf/Exam_(2017_1-Spring)/(2017_1-Spring)_(02).pdf <span style='font-size: 12px; background-color: yellow; border: solid; border-width: 1px; border-radius: 5px; padding: 2px 5px 2px 5px; margin: 5px;'>E</span>] <span style='color: red;'>'''(2017.Spring #2)'''</span> | ||

| + | || [[Werner05.Premium]] | ||

| + | || '''variable expense ratio''' <br> - for U/W profit 5% | ||

| + | || [[Werner05.Premium]] | ||

| + | || [[Werner05.Premium]] | ||

| − | |- | + | |- style="border-bottom: solid 2px;" |

|| [https://www.battleacts5.ca/pdf/Exam_(2017_1-Spring)/(2017_1-Spring)_(04).pdf <span style='font-size: 12px; background-color: yellow; border: solid; border-width: 1px; border-radius: 5px; padding: 2px 5px 2px 5px; margin: 5px;'>E</span>] <span style='color: red;'>'''(2017.Spring #4)'''</span> | || [https://www.battleacts5.ca/pdf/Exam_(2017_1-Spring)/(2017_1-Spring)_(04).pdf <span style='font-size: 12px; background-color: yellow; border: solid; border-width: 1px; border-radius: 5px; padding: 2px 5px 2px 5px; margin: 5px;'>E</span>] <span style='color: red;'>'''(2017.Spring #4)'''</span> | ||

| − | || | + | || '''expense ratio''' <br> - C&B, general |

| − | || | + | || '''permissible LR''' <br> - calculate |

| − | || | + | || '''U/W profit provision < 0''' <br> - is profit possible? |

| − | || | + | || '''U/W profit expectations''' <br> - met / not met |

|- | |- | ||

|| [https://www.battleacts5.ca/pdf/Exam_(2016_2-Fall)/(2016_2-Fall)_(06).pdf <span style='font-size: 12px; background-color: yellow; border: solid; border-width: 1px; border-radius: 5px; padding: 2px 5px 2px 5px; margin: 5px;'>E</span>] <span style='color: red;'>'''(2016.Fall #6)'''</span> | || [https://www.battleacts5.ca/pdf/Exam_(2016_2-Fall)/(2016_2-Fall)_(06).pdf <span style='font-size: 12px; background-color: yellow; border: solid; border-width: 1px; border-radius: 5px; padding: 2px 5px 2px 5px; margin: 5px;'>E</span>] <span style='color: red;'>'''(2016.Fall #6)'''</span> | ||

| − | || | + | || '''expense provision''' <br> - actuary's approach |

| − | || | + | || '''expense provision''' <br> - alternative approach |

| − | || | + | | style="background-color: lightgrey;" | |

| − | || | + | | style="background-color: lightgrey;" | |

| − | |- | + | |- style="border-bottom: solid 2px;" |

|| [https://www.battleacts5.ca/pdf/Exam_(2016_1-Spring)/(2016_1-Spring)_(07).pdf <span style='font-size: 12px; background-color: yellow; border: solid; border-width: 1px; border-radius: 5px; padding: 2px 5px 2px 5px; margin: 5px;'>E</span>] <span style='color: red;'>'''(2016.Spring #7)'''</span> | || [https://www.battleacts5.ca/pdf/Exam_(2016_1-Spring)/(2016_1-Spring)_(07).pdf <span style='font-size: 12px; background-color: yellow; border: solid; border-width: 1px; border-radius: 5px; padding: 2px 5px 2px 5px; margin: 5px;'>E</span>] <span style='color: red;'>'''(2016.Spring #7)'''</span> | ||

| − | || | + | || '''premium-based method''' <br> - indicated average rate |

| − | || | + | || '''achieve target profit''' <br> - without changing rates? |

| − | || | + | | style="background-color: lightgrey;" | |

| − | || | + | | style="background-color: lightgrey;" | |

| − | |- | + | |- style="border-bottom: solid 2px;" |

|| [https://www.battleacts5.ca/pdf/Exam_(2014_2-Fall)/(2014_2-Fall)_(06).pdf <span style='font-size: 12px; background-color: yellow; border: solid; border-width: 1px; border-radius: 5px; padding: 2px 5px 2px 5px; margin: 5px;'>E</span>] <span style='color: red;'>'''(2014.Fall #6)'''</span> | || [https://www.battleacts5.ca/pdf/Exam_(2014_2-Fall)/(2014_2-Fall)_(06).pdf <span style='font-size: 12px; background-color: yellow; border: solid; border-width: 1px; border-radius: 5px; padding: 2px 5px 2px 5px; margin: 5px;'>E</span>] <span style='color: red;'>'''(2014.Fall #6)'''</span> | ||

| − | || | + | || '''variable expense method''' <br> - indicated average rate |

| − | || | + | || '''premium-based method''' <br> - indicated average rate |

| − | || | + | || ''' excessive or inadequate''' <br> - indicated average rate |

| − | || | + | | style="background-color: lightgrey;" | |

|- | |- | ||

|| [https://www.battleacts5.ca/pdf/Exam_(2013_2-Fall)/(2013_2-Fall)_(07).pdf <span style='font-size: 12px; background-color: yellow; border: solid; border-width: 1px; border-radius: 5px; padding: 2px 5px 2px 5px; margin: 5px;'>E</span>] <span style='color: red;'>'''(2013.Fall #7)'''</span> | || [https://www.battleacts5.ca/pdf/Exam_(2013_2-Fall)/(2013_2-Fall)_(07).pdf <span style='font-size: 12px; background-color: yellow; border: solid; border-width: 1px; border-radius: 5px; padding: 2px 5px 2px 5px; margin: 5px;'>E</span>] <span style='color: red;'>'''(2013.Fall #7)'''</span> | ||

| − | || | + | || '''premium-based method''' <br> - versus exposure-based |

| − | || | + | || '''premium-based method''' <br> - versus exposure-based |

| − | || | + | | style="background-color: lightgrey;" | |

| − | || | + | | style="background-color: lightgrey;" | |

|- | |- | ||

|| [https://www.battleacts5.ca/pdf/Exam_(2013_2-Fall)/(2013_2-Fall)_(12).pdf <span style='font-size: 12px; background-color: yellow; border: solid; border-width: 1px; border-radius: 5px; padding: 2px 5px 2px 5px; margin: 5px;'>E</span>] <span style='color: red;'>'''(2013.Fall #12)'''</span> | || [https://www.battleacts5.ca/pdf/Exam_(2013_2-Fall)/(2013_2-Fall)_(12).pdf <span style='font-size: 12px; background-color: yellow; border: solid; border-width: 1px; border-radius: 5px; padding: 2px 5px 2px 5px; margin: 5px;'>E</span>] <span style='color: red;'>'''(2013.Fall #12)'''</span> | ||

| − | || | + | || '''pricing strategy''' <br> - evaluate |

| − | || | + | | style="background-color: lightgrey;" | |

| − | || | + | | style="background-color: lightgrey;" | |

| − | || | + | | style="background-color: lightgrey;" | |

|- | |- | ||

|| [https://www.battleacts5.ca/pdf/Exam_(2013_1-Spring)/(2013_1-Spring)_(09).pdf <span style='font-size: 12px; background-color: yellow; border: solid; border-width: 1px; border-radius: 5px; padding: 2px 5px 2px 5px; margin: 5px;'>E</span>] <span style='color: red;'>'''(2013.Spring #9)'''</span> | || [https://www.battleacts5.ca/pdf/Exam_(2013_1-Spring)/(2013_1-Spring)_(09).pdf <span style='font-size: 12px; background-color: yellow; border: solid; border-width: 1px; border-radius: 5px; padding: 2px 5px 2px 5px; margin: 5px;'>E</span>] <span style='color: red;'>'''(2013.Spring #9)'''</span> | ||

| − | || | + | || [[Werner08.Indication]] <span style="color: red;"><sup>'''1'''</sup> |

| − | || | + | || '''expense provision''' <br> - fixed vs variable |

| − | || | + | || '''expense provision''' <br> - fixed vs variable |

| − | || | + | | style="background-color: lightgrey;" | |

|} | |} | ||

| + | |||

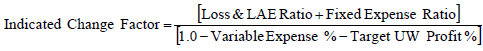

| + | : <span style="color: red;"><sup>'''1'''</sup></span> For this problem you need the indicated rate change formula from chapter 8: [[File: Werner08_(050)_indicated_rate_change.png]] | ||

| + | |||

| + | [https://www.battleacts5.ca/FC.php?selectString=**&filter=both&sortOrder=natural&colorFlag=allFlag&colorStatus=allStatus&priority=importance-high&subsetFlag=miniQuiz&prefix=Werner07&suffix=LossLAE§ion=all&subSection=all&examRep=all&examYear=all&examTerm=all&quizNum=all<span style="font-size: 20px; background-color: lightgreen; border: solid; border-width: 1px; border-radius: 10px; padding: 2px 10px 2px 10px; margin: 10px;">'''Full BattleQuiz]'''</span> | ||

==In Plain English!== | ==In Plain English!== | ||

| + | ===Intro=== | ||

| + | |||

| + | Recall the Fundamental Insurance Equation: | ||

| + | |||

| + | : premium = (Losses + LAE + U/W Expenses) + U/W profit | ||

| + | |||

| + | Our goal in a ratemaking analysis is to estimate each of these components for the period when the proposed rates will be in effect. We learned how to do this for premium in ''[[Werner05.Premium | Chapter 5]]'' and for losses and LAE in ''[[Werner06.LossLAE | Chapter 6]]''. In this chapter, we're going to do the same thing for U/W Expenses and U/W profit. ''(We'll also take another quick look at how reinsurance fits into the big picture.) | ||

| + | |||

| + | ===A Simple Example=== | ||

| + | |||

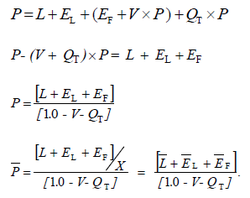

| + | Click ''[[Notation - Pricing]]'' for a full list of the notation used in Werner. This example looks more complicated than it really is because of all the notation but once you get past that, it's just simple algebra. The notation we need in this section is as follows. Note that total exposures is denoted by ''X'': | ||

| + | |||

| + | * '''''P'', <span style="text-decoration: overline;">''P'''''</span> → Premium, Average premium (P divided by X) | ||

| + | * '''''L'', ''<span style="text-decoration: overline;">L</span>''''' → Losses, Pure Premium (''L'' divided by ''X'') | ||

| + | * '''''E<sub>L</sub>'', ''<span style="text-decoration: overline;">E</span><sub>L</sub>''''' → Loss Adjustment Expense (LAE), Average LAE per exposure (''E<sub>L</sub>'' divided by ''X'') | ||

| + | * '''''E<sub>F</sub>'', ''<span style="text-decoration: overline;">E</span><sub>F</sub>''''' → Fixed underwriting expenses, Average underwriting expense per exposure (''E<sub>F</sub>'' divided by ''X'') | ||

| + | |||

| + | For the above variables, the total dollar amount is listed first and the average dollar amount is listed second. The average amount equals the total divided by total exposures ''X''. | ||

| + | |||

| + | * '''''V''''' → Variable expense provision (''E<sub>V</sub>'' divided by ''P'') | ||

| + | * '''''Q<sub>T</sub>''''' → Target profit percentage | ||

| + | |||

| + | This is going to be your very first rate indication. Use the Fundamental Insurance Equation to calculate the '''average premium''' the insurer must charge. | ||

| + | |||

| + | * ''<span style="text-decoration: overline;">L</span>'' + ''<span style="text-decoration: overline;">E</span><sub>L</sub>'' = $180 ''(average Loss + LAE)'' | ||

| + | * ''<span style="text-decoration: overline;">E</span><sub>F</sub>'' = $20 ''(fixed U/W expenses)'' | ||

| + | * ''V'' = 15% ''(includes premium taxes and other things)'' | ||

| + | * ''Q<sub>T</sub>'' = 5% ''(target profit percentage)'' | ||

| + | |||

| + | The target profit percentage is the compensation an insurer receives for taking on the risk. In a bad year they would make less than 5%; in a good year, more. Over a longer time period, it should average out to 5%. ''(This doesn't include investment income.)'' We're going write the Fundamental Insurance Equation using this notation then solve for <span style="text-decoration: overline;">''P'''''</span>. Note that in the last step, we divide both sides by ''X'' to switch from total dollar amounts to average dollar amounts. | ||

| + | |||

| + | : [[File: Werner07_(010)_derive_formula_avg_prem.png | 250px]] | ||

| + | |||

| + | Now just substitute the given values into the final formula: | ||

| + | |||

| + | : <span style="text-decoration: overline;">''P''</span> = ($180 + $20) / (1.0 - 0.15 - 0.05) = $<u>250</u> | ||

| + | |||

| + | You can practice a slightly harder variation of this problem in the quiz. | ||

| + | |||

| + | [https://www.battleacts5.ca/FC.php?selectString=**&filter=both&sortOrder=natural&colorFlag=allFlag&colorStatus=allStatus&priority=importance-high&subsetFlag=miniQuiz&prefix=Werner07&suffix=LossLAE§ion=all&subSection=all&examRep=all&examYear=all&examTerm=all&quizNum=1<span style="font-size: 20px; background-color: aqua; border: solid; border-width: 1px; border-radius: 10px; padding: 2px 10px 2px 10px; margin: 10px;">'''mini BattleQuiz 1]'''</span> | ||

| + | |||

| + | ===Underwriting Expense Categories=== | ||

| + | |||

| + | ===All Variable Expense Method=== | ||

| + | |||

| + | ===Premium-Based Projection Method=== | ||

| + | |||

| + | ===Exposure-Based or Policy-Based Projection Method=== | ||

| + | |||

| + | ===Trending Expenses=== | ||

| + | |||

| + | ===Reinsurance Costs=== | ||

| + | |||

| + | ===Underwriting Profit Provision=== | ||

| + | |||

| + | ===Permissible Loss Ratios=== | ||

==POP QUIZ ANSWERS== | ==POP QUIZ ANSWERS== | ||

Revision as of 00:40, 20 October 2020

Reading: BASIC RATEMAKING, Fifth Edition, May 2016, Geoff Werner, FCAS, MAAA & Claudine Modlin, FCAS, MAAA Willis Towers Watson

Chapter 7: Other Expenses and Profit

Pop Quiz

Study Tips

BattleTable

Based on past exams, the main things you need to know (in rough order of importance) are:

- fact A...

- fact B...

reference part (a) part (b) part (c) part (d) E (2019.Fall #6) Werner06.LossLAE profit provision

- investment incometrending

- necessary when...E (2019.Spring #6) total expense ratio

- all expenses variablevariable permissible LR:

- calculatedistortions

- due to expense ratiovariable permissible LR:

- calculateE (2018.Fall #6) premium-based method

- versus exposure-basedpremium-based method

- versus exposure-basedE (2018.Spring #7) Excel Practice Problems E (2017.Fall #7) premium-based method

- U/W expense ratiopremium-based method

- operating expense ratiototal permissible LR

- calculateWerner08.Indication 1 E (2017.Spring #2) Werner05.Premium variable expense ratio

- for U/W profit 5%Werner05.Premium Werner05.Premium E (2017.Spring #4) expense ratio

- C&B, generalpermissible LR

- calculateU/W profit provision < 0

- is profit possible?U/W profit expectations

- met / not metE (2016.Fall #6) expense provision

- actuary's approachexpense provision

- alternative approachE (2016.Spring #7) premium-based method

- indicated average rateachieve target profit

- without changing rates?E (2014.Fall #6) variable expense method

- indicated average ratepremium-based method

- indicated average rateexcessive or inadequate

- indicated average rateE (2013.Fall #7) premium-based method

- versus exposure-basedpremium-based method

- versus exposure-basedE (2013.Fall #12) pricing strategy

- evaluateE (2013.Spring #9) Werner08.Indication 1 expense provision

- fixed vs variableexpense provision

- fixed vs variable

In Plain English!

Intro

Recall the Fundamental Insurance Equation:

- premium = (Losses + LAE + U/W Expenses) + U/W profit

Our goal in a ratemaking analysis is to estimate each of these components for the period when the proposed rates will be in effect. We learned how to do this for premium in Chapter 5 and for losses and LAE in Chapter 6. In this chapter, we're going to do the same thing for U/W Expenses and U/W profit. (We'll also take another quick look at how reinsurance fits into the big picture.)

A Simple Example

Click Notation - Pricing for a full list of the notation used in Werner. This example looks more complicated than it really is because of all the notation but once you get past that, it's just simple algebra. The notation we need in this section is as follows. Note that total exposures is denoted by X:

- P, P → Premium, Average premium (P divided by X)

- L, L → Losses, Pure Premium (L divided by X)

- EL, EL → Loss Adjustment Expense (LAE), Average LAE per exposure (EL divided by X)

- EF, EF → Fixed underwriting expenses, Average underwriting expense per exposure (EF divided by X)

For the above variables, the total dollar amount is listed first and the average dollar amount is listed second. The average amount equals the total divided by total exposures X.

- V → Variable expense provision (EV divided by P)

- QT → Target profit percentage

This is going to be your very first rate indication. Use the Fundamental Insurance Equation to calculate the average premium the insurer must charge.

- L + EL = $180 (average Loss + LAE)

- EF = $20 (fixed U/W expenses)

- V = 15% (includes premium taxes and other things)

- QT = 5% (target profit percentage)

The target profit percentage is the compensation an insurer receives for taking on the risk. In a bad year they would make less than 5%; in a good year, more. Over a longer time period, it should average out to 5%. (This doesn't include investment income.) We're going write the Fundamental Insurance Equation using this notation then solve for P. Note that in the last step, we divide both sides by X to switch from total dollar amounts to average dollar amounts.

Now just substitute the given values into the final formula:

- P = ($180 + $20) / (1.0 - 0.15 - 0.05) = $250

You can practice a slightly harder variation of this problem in the quiz.