Difference between revisions of "Werner07.OtherExpenses"

(→BattleTable) |

|||

| Line 8: | Line 8: | ||

==Study Tips== | ==Study Tips== | ||

| + | |||

| + | Werner is well-written but I found chapter 7 to be a little wordy. There 3 types of expense ratio methods you have to learn. In the previous chapter we looked at LAE ''(Loss Adjustment Expenses)'' and in this chapter we look at underwriting expenses. The goal here is to project an underwriting expense ratio for use in a ratemaking analysis. Depending on the method, the expense ratio may be split between fixed and variable expenses. | ||

| + | |||

| + | * Method 1: All Variable Expense Method | ||

| + | * Method 2: Premium-Based Projection Method <span style="color: green;"> ← '''this is the most frequently asked method'''</span> | ||

| + | * Method 3: Exposure-Based (Policy-Based) Projection Method | ||

| + | |||

| + | ''(I find these easier than trending and on-leveling problems from previous chapters.)'' | ||

| + | |||

| + | There is also has an brief introduction to calculating a premium rate, a topic that's covered in detail in ''[[Werner08.Indication | Pricing - Chapter 8]]''. Aside from the mechanics of each method, you also need to know their advantages and disadvantages. | ||

| + | |||

| + | '''Estimated study time''': 3 days ''(not including subsequent review time)'' | ||

==BattleTable== | ==BattleTable== | ||

| Line 114: | Line 126: | ||

|} | |} | ||

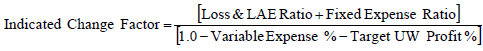

| − | : <span style="color: red;"><sup>'''1'''</sup></span> For this problem you need the indicated rate change formula from chapter 8: [[File: Werner08_(050)_indicated_rate_change.png]] | + | : <span style="color: red;"><sup>'''1'''</sup></span> For this problem you need the indicated rate <u>change</u> formula from chapter 8: [[File: Werner08_(050)_indicated_rate_change.png]] |

| − | [https://www.battleacts5.ca/FC.php?selectString=**&filter=both&sortOrder=natural&colorFlag=allFlag&colorStatus=allStatus&priority=importance-high&subsetFlag=miniQuiz&prefix=Werner07&suffix=OtherExpenses§ion=all&subSection=all&examRep=all&examYear=all&examTerm=all&quizNum=all<span style="font-size: 20px; background-color: lightgreen; border: solid; border-width: 1px; border-radius: 10px; padding: 2px 10px 2px 10px; margin: 10px;">'''Full BattleQuiz] | + | [https://www.battleacts5.ca/FC.php?selectString=**&filter=both&sortOrder=natural&colorFlag=allFlag&colorStatus=allStatus&priority=importance-high&subsetFlag=miniQuiz&prefix=Werner07&suffix=OtherExpenses§ion=all&subSection=all&examRep=all&examYear=all&examTerm=all&quizNum=all<span style="font-size: 20px; background-color: lightgreen; border: solid; border-width: 1px; border-radius: 10px; padding: 2px 10px 2px 10px; margin: 10px;">'''Full BattleQuiz]'''</span> |

==In Plain English!== | ==In Plain English!== | ||

| Line 137: | Line 149: | ||

* '''''E<sub>F</sub>'', ''<span style="text-decoration: overline;">E</span><sub>F</sub>''''' → Fixed underwriting expenses, Average underwriting expense per exposure (''E<sub>F</sub>'' divided by ''X'') | * '''''E<sub>F</sub>'', ''<span style="text-decoration: overline;">E</span><sub>F</sub>''''' → Fixed underwriting expenses, Average underwriting expense per exposure (''E<sub>F</sub>'' divided by ''X'') | ||

| − | For the above variables, the total dollar amount is listed first and the average dollar amount is listed second. The average amount equals the total divided by | + | For the above variables, the total dollar amount is listed first and the average dollar amount is listed second. The average amount equals the total amount divided by exposures ''X''. |

* '''''V''''' → Variable expense provision (''E<sub>V</sub>'' divided by ''P'') | * '''''V''''' → Variable expense provision (''E<sub>V</sub>'' divided by ''P'') | ||

| Line 149: | Line 161: | ||

* ''Q<sub>T</sub>'' = 5% ''(target profit percentage)'' | * ''Q<sub>T</sub>'' = 5% ''(target profit percentage)'' | ||

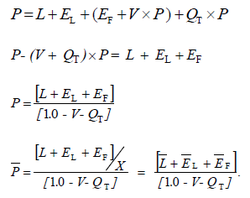

| − | The target profit percentage is the compensation an insurer receives for taking on | + | The target profit percentage is the compensation an insurer receives for taking on risk. In a bad year they would make less than 5%; in a good year, more. Over a longer time period, the average should be roughly 5%. ''(This doesn't include investment income.)'' We're going write the Fundamental Insurance Equation using this notation then solve for <span style="text-decoration: overline;">''P'''''</span>. Note that in the last step, we divide both sides by ''X'' to switch from total dollar amounts to average dollar amounts. |

: [[File: Werner07_(010)_derive_formula_avg_prem.png | 250px]] | : [[File: Werner07_(010)_derive_formula_avg_prem.png | 250px]] | ||

| Line 163: | Line 175: | ||

===Underwriting Expense Categories=== | ===Underwriting Expense Categories=== | ||

| − | ===All Variable Expense Method=== | + | Underwriting expenses are expenses incurred in the acquisition and servicing of policies. They are also referred to as operational and administrative expenses. |

| + | |||

| + | :{| class='wikitable' | ||

| + | |- | ||

| + | || '''Question''': what are the 4 categories of U/W expenses | ||

| + | |} | ||

| + | |||

| + | :: '''Commissions & Brokerage''': payment to agents or brokers for generating business | ||

| + | :: '''Other Acquisition''': expenses for generating business, other Commissions and Brokerage | ||

| + | :: '''Taxes, Licenses & Fees''': all taxes and fees <u>excluding</u> federal income tax (Ex: premium taxes) | ||

| + | :: '''General''': all remaining expenses (Ex: building maintenance, salaries) | ||

| + | |||

| + | These expense categories can be further split into fixed expenses and variable expenses. Fixed expenses are the same for each risk. An simple example is the cost of an auto insurance policy form. It doesn't matter whether the premium is $300 or $800, the cost of the printed form is the same. Variable expenses are different for each risk and are expressed as a percentage of premium. An example is agents' commission which is typically 10-15% of written premium. | ||

| + | |||

| + | We're going to cover 3 methods for calculating the U/W expense term in the Fundamental Insurance Equation. The premium-based projection method appears most often on past exams. | ||

| + | |||

| + | ===METHOD 1: All Variable Expense Method=== | ||

| + | |||

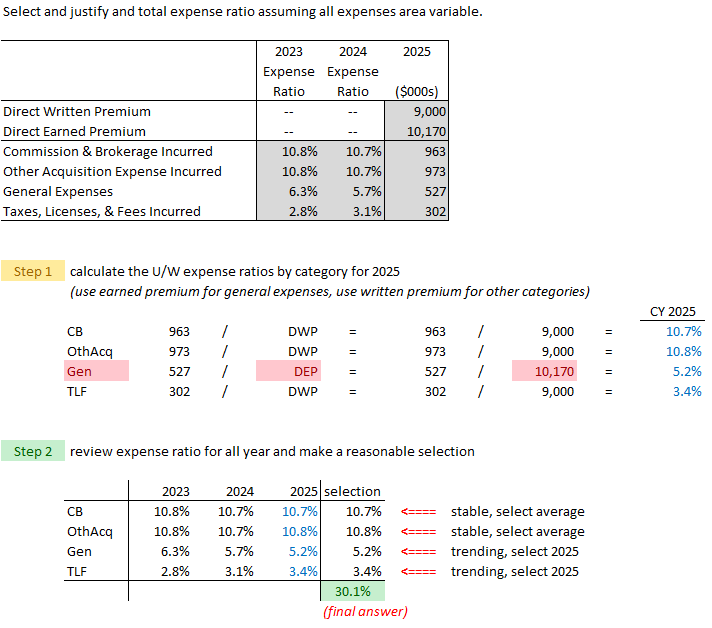

| + | This first method assumes all 4 categories of expenses are variable. That means the amounts vary with premium. In the example below, you're given the expense ratios for calendar years 2023 and 2024 and the dollar amounts for 2025. You have to calculate the ratios for 2025 then use information from all 3 years to select an appropriate total expense ratio for a ratemaking analysis. | ||

| + | |||

| + | For example, the Commissions and Brokerage ratio for 2025 is 963/DWP = 963/9000 = <u>10.7</u>%. It's an easy calculation but you have to be careful whether to use written or earned premium in the denominator. Commissions and brokerage expenses are incurred when the policy is written so it's logical to express them as a percentage of written premium. General expenses however ''(like building maintenance and salaries)'' are incurred over the policy term so we match them to premium earnings over that same time frame. Note that Other Acquisition and TLF are incurred at policy inception so we use written premium for those as shown in the solution below. | ||

| + | |||

| + | : [[File: Werner07_(020)_expense_ratio_method_1.png]] | ||

| + | |||

| + | Here are 2 practice problems on this method: | ||

| + | |||

| + | : [https://www.battleacts5.ca/pdf/W-07_(020)_(19S.06)_practice_all_variable_expense_method_1.pdf <span style="color: white; font-size: 12px; background-color: green; border: solid; border-width: 2px; border-radius: 10px; border-color: green; padding: 1px 3px 1px 3px; margin: 0px;">'''''Practice: 2 Expense Ratio Problems (like 2019.Spring #6a)'''''</span>] | ||

| − | ===Premium-Based Projection Method=== | + | ===METHOD 2: Premium-Based Projection Method=== |

| − | ===Exposure-Based or Policy-Based Projection Method=== | + | ===METHOD 3: Exposure-Based or Policy-Based Projection Method=== |

===Trending Expenses=== | ===Trending Expenses=== | ||

Revision as of 18:52, 22 October 2020

Reading: BASIC RATEMAKING, Fifth Edition, May 2016, Geoff Werner, FCAS, MAAA & Claudine Modlin, FCAS, MAAA Willis Towers Watson

Chapter 7: Other Expenses and Profit

Contents

- 1 Pop Quiz

- 2 Study Tips

- 3 BattleTable

- 4 In Plain English!

- 4.1 Intro

- 4.2 A Simple Example

- 4.3 Underwriting Expense Categories

- 4.4 METHOD 1: All Variable Expense Method

- 4.5 METHOD 2: Premium-Based Projection Method

- 4.6 METHOD 3: Exposure-Based or Policy-Based Projection Method

- 4.7 Trending Expenses

- 4.8 Reinsurance Costs

- 4.9 Underwriting Profit Provision

- 4.10 Permissible Loss Ratios

- 5 POP QUIZ ANSWERS

Pop Quiz

Study Tips

Werner is well-written but I found chapter 7 to be a little wordy. There 3 types of expense ratio methods you have to learn. In the previous chapter we looked at LAE (Loss Adjustment Expenses) and in this chapter we look at underwriting expenses. The goal here is to project an underwriting expense ratio for use in a ratemaking analysis. Depending on the method, the expense ratio may be split between fixed and variable expenses.

- Method 1: All Variable Expense Method

- Method 2: Premium-Based Projection Method ← this is the most frequently asked method

- Method 3: Exposure-Based (Policy-Based) Projection Method

(I find these easier than trending and on-leveling problems from previous chapters.)

There is also has an brief introduction to calculating a premium rate, a topic that's covered in detail in Pricing - Chapter 8. Aside from the mechanics of each method, you also need to know their advantages and disadvantages.

Estimated study time: 3 days (not including subsequent review time)

BattleTable

Based on past exams, the main things you need to know (in rough order of importance) are:

- fact A...

- fact B...

reference part (a) part (b) part (c) part (d) E (2019.Fall #6) Werner06.LossLAE profit provision

- investment incometrending

- necessary when...E (2019.Spring #6) total expense ratio

- all expenses variablevariable permissible LR:

- calculatedistortions

- due to expense ratiovariable permissible LR:

- calculateE (2018.Fall #6) premium-based method

- versus exposure-basedpremium-based method

- versus exposure-basedE (2018.Spring #7) Excel Practice Problems E (2017.Fall #7) premium-based method

- U/W expense ratiopremium-based method

- operating expense ratiototal permissible LR

- calculateWerner08.Indication 1 E (2017.Spring #2) Werner05.Premium variable expense ratio

- for U/W profit 5%Werner05.Premium Werner05.Premium E (2017.Spring #4) expense ratio

- C&B, generalpermissible LR

- calculateU/W profit provision < 0

- is profit possible?U/W profit expectations

- met / not metE (2016.Fall #6) expense provision

- actuary's approachexpense provision

- alternative approachE (2016.Spring #7) premium-based method

- indicated average rateachieve target profit

- without changing rates?E (2014.Fall #6) variable expense method

- indicated average ratepremium-based method

- indicated average rateexcessive or inadequate

- indicated average rateE (2013.Fall #7) premium-based method

- versus exposure-basedpremium-based method

- versus exposure-basedE (2013.Fall #12) pricing strategy

- evaluateE (2013.Spring #9) Werner08.Indication 1 expense provision

- fixed vs variableexpense provision

- fixed vs variable

In Plain English!

Intro

Recall the Fundamental Insurance Equation:

- premium = (Losses + LAE + U/W Expenses) + U/W profit

Our goal in a ratemaking analysis is to estimate each of these components for the period when the proposed rates will be in effect. We learned how to do this for premium in Chapter 5 and for losses and LAE in Chapter 6. In this chapter, we're going to do the same thing for U/W Expenses and U/W profit. (We'll also take another quick look at how reinsurance fits into the big picture.)

A Simple Example

Click Notation - Pricing for a full list of the notation used in Werner. This example looks more complicated than it really is because of all the notation but once you get past that, it's just simple algebra. The notation we need in this section is as follows. Note that total exposures is denoted by X:

- P, P → Premium, Average premium (P divided by X)

- L, L → Losses, Pure Premium (L divided by X)

- EL, EL → Loss Adjustment Expense (LAE), Average LAE per exposure (EL divided by X)

- EF, EF → Fixed underwriting expenses, Average underwriting expense per exposure (EF divided by X)

For the above variables, the total dollar amount is listed first and the average dollar amount is listed second. The average amount equals the total amount divided by exposures X.

- V → Variable expense provision (EV divided by P)

- QT → Target profit percentage

This is going to be your very first rate indication. Use the Fundamental Insurance Equation to calculate the average premium the insurer must charge.

- L + EL = $180 (average Loss + LAE)

- EF = $20 (fixed U/W expenses)

- V = 15% (includes premium taxes and other things)

- QT = 5% (target profit percentage)

The target profit percentage is the compensation an insurer receives for taking on risk. In a bad year they would make less than 5%; in a good year, more. Over a longer time period, the average should be roughly 5%. (This doesn't include investment income.) We're going write the Fundamental Insurance Equation using this notation then solve for P. Note that in the last step, we divide both sides by X to switch from total dollar amounts to average dollar amounts.

Now just substitute the given values into the final formula:

- P = ($180 + $20) / (1.0 - 0.15 - 0.05) = $250

You can practice a slightly harder variation of this problem in the quiz.

Underwriting Expense Categories

Underwriting expenses are expenses incurred in the acquisition and servicing of policies. They are also referred to as operational and administrative expenses.

Question: what are the 4 categories of U/W expenses

- Commissions & Brokerage: payment to agents or brokers for generating business

- Other Acquisition: expenses for generating business, other Commissions and Brokerage

- Taxes, Licenses & Fees: all taxes and fees excluding federal income tax (Ex: premium taxes)

- General: all remaining expenses (Ex: building maintenance, salaries)

These expense categories can be further split into fixed expenses and variable expenses. Fixed expenses are the same for each risk. An simple example is the cost of an auto insurance policy form. It doesn't matter whether the premium is $300 or $800, the cost of the printed form is the same. Variable expenses are different for each risk and are expressed as a percentage of premium. An example is agents' commission which is typically 10-15% of written premium.

We're going to cover 3 methods for calculating the U/W expense term in the Fundamental Insurance Equation. The premium-based projection method appears most often on past exams.

METHOD 1: All Variable Expense Method

This first method assumes all 4 categories of expenses are variable. That means the amounts vary with premium. In the example below, you're given the expense ratios for calendar years 2023 and 2024 and the dollar amounts for 2025. You have to calculate the ratios for 2025 then use information from all 3 years to select an appropriate total expense ratio for a ratemaking analysis.

For example, the Commissions and Brokerage ratio for 2025 is 963/DWP = 963/9000 = 10.7%. It's an easy calculation but you have to be careful whether to use written or earned premium in the denominator. Commissions and brokerage expenses are incurred when the policy is written so it's logical to express them as a percentage of written premium. General expenses however (like building maintenance and salaries) are incurred over the policy term so we match them to premium earnings over that same time frame. Note that Other Acquisition and TLF are incurred at policy inception so we use written premium for those as shown in the solution below.

Here are 2 practice problems on this method: