Werner08.Indication

Reading: BASIC RATEMAKING, Fifth Edition, May 2016, Geoff Werner, FCAS, MAAA & Claudine Modlin, FCAS, MAAA Willis Towers Watson

Chapter 8: Overall Indication

Contents

Study Tips

Good news: There is very little new material in chapter 8. You did all the hard work in earlier chapters and chapter 8 just ties everything together into an overall rate indication. There are 2 basic formulas:

- pure premium formula (we actually already covered this here in chapter 7.)

- loss ratio formula (provides the change in rates rather than a specific dollar-value as in the pure premium formula)

You'll need to memorize the advantages and disadvantages of each method but this won't take long. Most of your time will be spent doing practice problems. The source text shows how each formula is derived starting with the Fundamental Insurance Equation but this is no longer relevant on an Excel-based exam. (Some very old exam problems asked you to reproduce these derivations but this isn't feasible in Excel.)

BattleTable

Based on past exams, the main things you need to know (in rough order of importance) are:

- fact A...

- fact B...

reference part (a) part (b) part (c) E (2019.Fall #7) E (2019.Spring #7) E (2018.Fall #7) E (2017.Fall #15) E (2017.Spring #5) calculate:

- rate change (LR method)calculate:

- rate change (PP method)inappropriate situations for:

- LR method, PP methodE (2017.Spring #13) calculate:

- ultimate loss (capped)calculate:

- rate changereasons for:

- not taking full indicationE (2016.Fall #7) calculate:

- U/W profit provisionreasons for:

- variations in U/W profitE (2016.Fall #8) calculate:

- rate changeE (2016.Fall #9) calculate:

- rate changeE (2016.Spring #1) calculate:

- on-level loss ratioE (2016.Spring #6) calculate:

- rate changereasons for:

- profit & contingency provisionmethods:

- pure premium vs loss ratioE (2016.Spring #8) calculate:

- rate changeE (2015.Spring #9) calculate:

- average rateE (2014.Fall #7) calculate:

- rate changeE (2014.Spring #5) calculate:

- rate changeassess:

- complement of credibilityE (2013.Fall #4) calculate:

- rate change (2-step trend)EP @ CRL:

- alternative methodsimpact on indication:

- uniform premium earningE (2013.Spring #3) recommend improvements:

- to rate indicationE (2013.Spring #5) calculate:

- rate change

Full BattleQuiz You must be logged in or this will not work.

In Plain English!

Intro

Alice gave Ian-the-Intern this quiz when he arrived at work, and he got the right answer on only his second try. Exactly one of the following statements is true. Can you tell Alice which one it is?

- The goal of ratemaking is to set rates too low so that premium charged does not cover losses & expenses. The losses can then be written off the company's corporate taxes.

- The goal of ratemaking is to set rates too HIGH so that premium charged greatly exceeds losses & expenses and generates a huge profit. We can then finally get that espresso maker for the break room.

- The goal of a ratemaking analysis is to set rates so that premium charged covers losses & expenses and achieves the targeted profit for policies written during a future period

The correct answer is #3. Memorize it. It's just another way of saying the Fundamental Insurance Equation should be balanced. (Ian's first guess was #2 because he really likes espresso.)

Pure Premium Method

We covered the pure premium method here in chapter 7, and the first quiz in that section had a web-based problem for practice. You can review it briefly if necessary. The mathematical derivation of the formula was provided but I don't believe you'll be tested on that. I included it so you could see how the rate indication formula follows from the Fundamental Insurance Equation.

Note that the pure premium method requires exposure data, and gives you the dollar-value of the indicated rate. The loss ratio method discussed in the next section works a little differently. The loss ratio method requires premium data, and gives you the percent change from the previous rate.

Loss Ratio Method

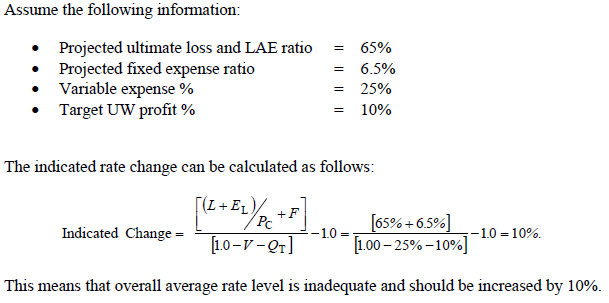

The source text does a nice job of explaining the loss ratio method in a simple way. Here's the formula:

Remember you can always use the link in the sidebar under Miscellaneous Battle Reports to review pricing notation. (You might have to scroll up to see the sidebar liknks.) Or use the direct link Notation - Pricing. But just to save you a little time, here's the notation used in the above formula:

- L → Losses

- EL → Loss Adjustment Expense (LAE)

- Pc → Premium at current rates

- F → Fixed U/W Expense ratio

- V → Variable Expense Provision

- QT → Target profit percentage

The the text provides a nice simple example to show you how the formula works. Note they don't actually provide the values for L, EL, Pc. Instead they give you (L + EL)/Pc directly, which you can just toss into the numerator. They saved you like 5 seconds. :-)

Remember the key difference between the pure premium method and loss ratio method: The pure premium method gives you the dollar-value of the indicated rate whereas the loss ratio method gives the percent change from the previous rate. If you think about that for a moment, you'll see that the loss ratio method cannot be used for a brand new line of business because a new line of business wouldn't have a previous rate. In that scenario, you would have to use the pure premium method.

The source text also shows how the loss ratio formula is derived starting with the Fundamental Insurance Equation, and that it's algebraically equivalent to the pure premium method. That means if you have the necessary input data, both methods should give the same result. (If you have both the indicated rate from the pure premium method as well as the prior rate, you can calculate the rate change and compare it to the result from the loss ratio method.) The quiz has slightly harder version of this example for practice.

Full BattleQuiz You must be logged in or this will not work.