Werner15.Commercial

Reading: BASIC RATEMAKING, Fifth Edition, May 2016, Geoff Werner, FCAS, MAAA & Claudine Modlin, FCAS, MAAA, Willis Towers Watson

Chapter 15: Commercial Lines Rating Mechanisms

Pop Quiz

The Fundamental Insurance Equation can be put into balance using non-pricing solutions. What is 1 way that losses can be reduced without changing prices? Click for Answer

Study Tips

VIDEO: W-15 (001) Commercial Rating → 5:00 Forum

This chapter on commercial pricing has 5 different types of calculation problems. They are all fairly easy but there are a lot of formulas to memorize and there's no way around that. You can see from the BattleTable that the most frequently asked question is on retrospective rating. There was also a question from the 2018.Spring TBE exam (question 15b from version 1) that had a question on that topic. If you're running out of time to study, you should at least make sure you know how to do a retrospective rating problem. Question 15a from that TBE exam was a calculation on experience rating for WC (Worker's Compensation).

Recent exam questions from chapter 15 have focused more on concepts than on calculations but I wouldn't entirely rule out a calculation problem.

| Click the little numbers to take the express train directly to the problem! |

- 1 Manual Rate Modification: CGL

- 2 Manual Rate Modification: WC

- 3 Large Commercial Policies: Loss-Rated Composite Rating

- 4 Large Commercial Policies: Large Deductibles

- 5 Large Commercial Policies: Retrospective Rating

Estimated study time:

- 1 day to learn the concepts behind all methods and how to do a retrospective rating problem (not including subsequent review)

- 3 days to learn the concepts behind all methods and how to do all 5 calculation problems. (not including subsequent review)

BattleTable

Based on past exams, the main things you need to know (in rough order of importance) are:

- retrospective rating - calculating premium and miscellaneous facts

- large deductibles - calculating premium and miscellaneous facts

reference part (a) part (b) part (c) part (d) E (2019.Fall #9) classification rating

- vs individual ratingclassification rating

- vs individual ratingclassification rating

- rating characteristicsE (2019.Fall #15) WC program changes:

- premium effectWC program changes:

- premium effectWC program changes:

- new rating mechanismE (2019.Spring #11) large deductibles

- expense concernslarge deductibles

- bankruptcy concernslarge deductibles

- profit margin concerns(2018.Spring #15) BattleActs PowerPack E (2017.Spring #12) experience rating:

- calculate mod factorschedule rating:

- when it's appropriateE (2016.Fall #15) experience rating:

- calculate premiumE (2015.Fall #13) retrospective rating

- calculate premiumE (2014.Spring #11) retrospective rating

- calculate premiumretrospective rating

- basic premiumE (2013.Spring #13) large deductibles

- calculate premiumE (2013.Spring #15) retrospective rating

- calculate premiumretrospective rating

- adjustments

In Plain English!

Manual Rate Modification Methods

Manual rate modification methods rely on past experience and/or risk characteristics not adequately reflected in the manual rate or the past experience. There are two basic types of manual rate modification methods: experience rating & schedule rating. The calculation problems in this section calculate the adjustment that is multiplied by the manual rate to get the final rate.

Experience Rating

The experience rating adjustment is a credibility-weighting of the adjusted past experience (the "experience" component) and some expected results (referred to as the "expected" component). The experience component, based on an insured's prior loss data, is usually 2-5 policy years. Losses for the expected component are generally the product of an expected loss rate and an exposure measure.

Before getting into the example, there's a technicality that Alice wants to mention:

- the experience component and the expected component should be defined consistently

This just means that if your experience component uses paid loss (and ALAE) then your expected component should also use paid loss (and ALAE). You don't have to use paid loss (and ALAE) however. You could just as well use reported loss (and ALAE), ultimate loss (and ALAE), or ultimate loss (and ALAE) brought to current level. You just have to do it the same way for both the experience and expected components.

Example: CGL Policy

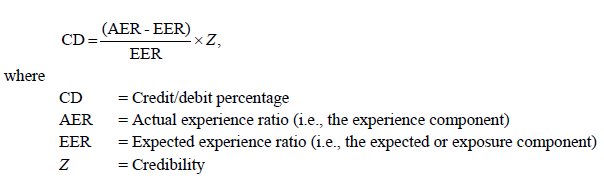

1 The basic formula for the adjustment to the manual rate is as follows:

| CGL adjustment formula: |

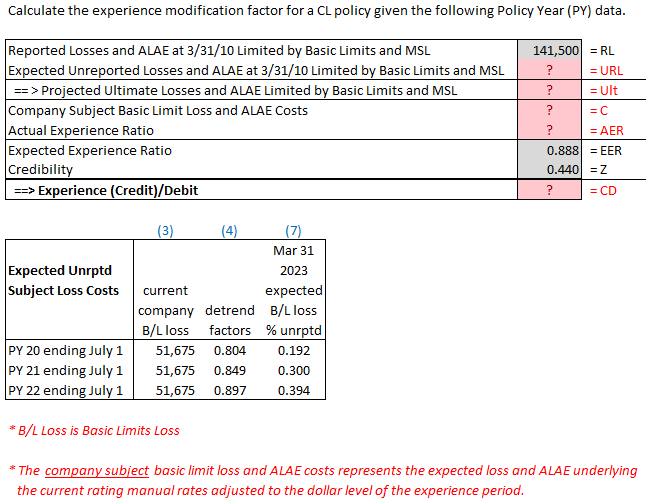

That's a pretty simple formula if you know AER, EER, and Z. You'll generally be given EER and Z. The bulk of the work is calculating AER. We'll see how to do this in the example below.

| Here's the problem... |

| Here's the solution |

Here are 2 practice problems like the previous example.

Example: WC Policy

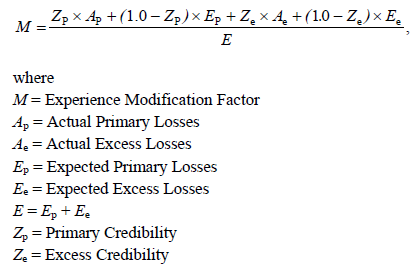

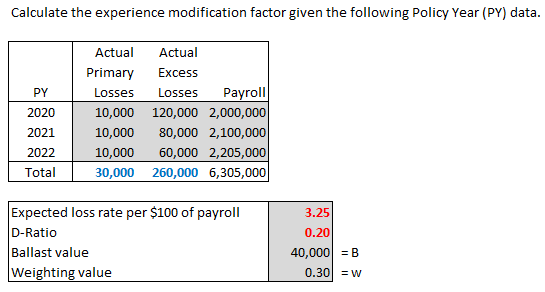

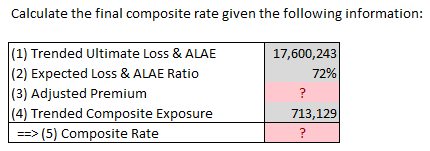

2 The National Council on Compensation Insurance (NCCI) is the rating and statistical organization of workers compensation insurance. The big picture is that WC policies are rated by multiplying the manual premium by an experience modification factor. In this section we'll learn how to calculate the experience modification factor. The calculation of the manual premium is not discussed. We will look at two examples of this, the first for a Commercial General Liability policy, and the second for a Worker's Compensation policy.

The NCCI Experience Rating Plan divides losses into primary and excess components. Both of these components are the credibility-weighted in the numerator so the numerator is the sum of 4 terms as shown below:

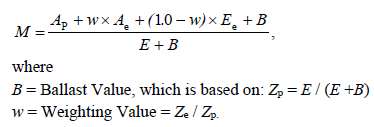

But you don't actually use that formula as written to calculate the experience modification. The details are beyond the scope of the syllabus but here we use an equivalent formulation: (k1996 has kindly offered a derivation of this formula as a hack in case you can't remember the formula on the exam.)

The ballast value and weighting value are obtained from a table based upon the policy's expected losses. Both values increase as expected losses increase. A problem like this appeared on the 2018.Spring TBE exam. It was easy if you memorized the above formula.

| Here's the statement of the problem... |

| Here's the solution: |

Here are 2 practice problems like the previous example.

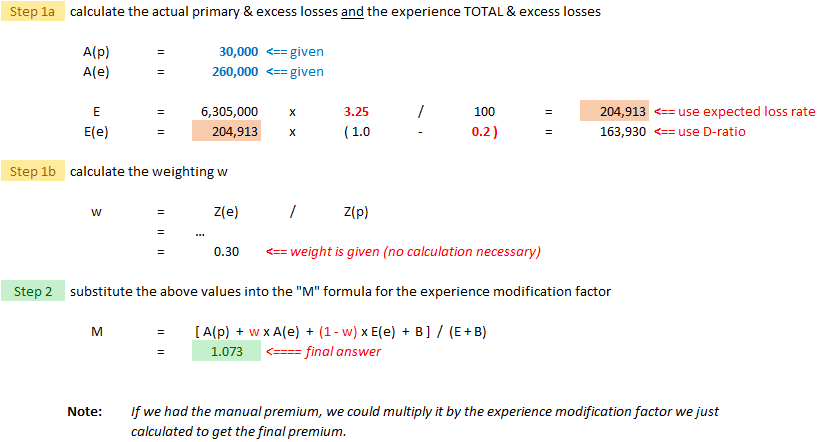

Schedule Rating

Schedule rating is another way tp modify the manual rate in commercial lines pricing. Schedule rating is based on a "schedule" that lists available percentage credits (reductions) and debits (increases) to the manual rate. It reflects characteristics that have a material effect on the risk but that are not reflected in the manual rate, or (if experience rating applies) not adequately reflected in the prior experience.

For example, implementing a new loss control program should lower the overall risk and a percentage credit would be applied to the insured's current rate. Note however that over time, the effects of the new loss control program would be reflected in the data so the percentage credit should gradually be reduced to avoid double-counting.

Here's what a portion of a schedule may look like:

The credit/debit is subject to an overall maximum and minimum.

Rating Mechanisms for Large Commercial Losses

The manual rate modification methods described earlier used past experience and/or risk characteristics to modify or adjust the manual rate. The methods in this section are different. Instead of calculating an adjustment, we directly develop the premium to be charged. The examples in this section cover:

- composite rating for loss-rated composite risks

- large deductible policies

- retrospective rating plans

They involve a lot of formulas but are otherwise straightforward.

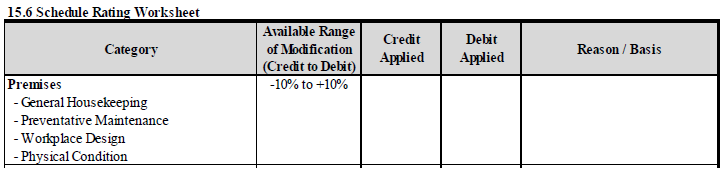

Composite Rating

3 Composite rating is useful for rating large, complex commercial risks where the amount of exposure is difficult to track throughout the policy period. There may be multiple relevant exposure bases covering different aspects of the commercial enterprise. For example, sales revenue for general liability and property value for commercial business property. Rather than track each individually, we might select a proxy such as property value. Then if property value increases by 10% during the policy term, the overall premium would also increase by 10%. This idea of a proxy is illustrated with an example further down.

Sometimes the composite rate is based entirely on the insured’s prior experience. This is called composite rating for loss-rated risks and is the example we'll be looking at. An insured is eligible for being classified as "loss-rated" if its historical reported losses and ALAE over a defined period exceed a specified aggregate dollar amount. Its experience is then considered 100% credible.

Werner outlines 4 steps for loss-rated composite rating. Note that the first 2 steps are not new. Step 1 is just normal development and trending of reported losses. Step 2 is trending of exposures. You can do steps 1 & 2 with what you learned in earlier pricing chapters.

- [1] Trended Ultimate Loss & ALAE by coverage by year = (Reported Loss & ALAE) x (Development Factor) x (Loss & ALAE Trend Factor)

- [2] Trended Composite Exposure = (Composite Exposure) x (Exposure Trend Factor)

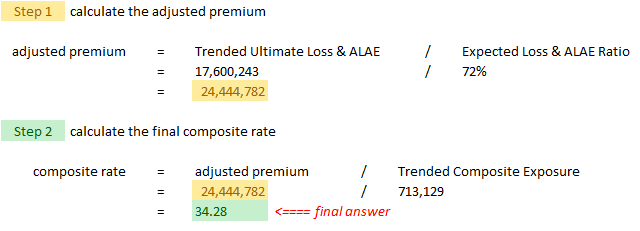

Our example shows steps 3 & 4, which are actually pretty simple. The final answer is given in step 4:

- [3] Adjusted Premium = (Trended Ultimate Loss & ALAE) / (Expected Loss & ALAE Ratio)

- [4] Composite Rate = (Adjusted Premium) / (Trended Composite Exposure)

We're not going to go through the full example from the text because as mentioned above, steps 1 & 2 can be done with material from earlier chapters. But it's good to understand the context of the example because it illustrates the idea of a proxy exposure base.

- The insured:

- Bob’s Rentals is an equipment dealer that sells new and used equipment, operates a repair and service shop, and offers leases and rentals on equipment it owns. There are 3 separate components to his CGL (Commercial General Liability Policy) and each has a different exposure base.

- → exposure for sales on new and used equipment is receipts (in $000s) attributable only to sales on new and used equipment

- → exposure for the repair and service shop is payroll (in $00s) relating to workers in the repair and service shop

- → for leases and rentals is receipts (in $000s) attributable only to leases and rentals

- The selected composite exposure base is total receipts (in $000s). This is the proxy. It would too confusing to track all 3 exposure bases separately so we select something that should be a good reflection of the overall risk.

We will assume that steps 1 & 2 have been performed. The results are shown as part of the given information in the example below. They are labelled (1) and (4) in the table.

| Here's the problem... |

| Here's the solution... |

Here are 2 practice problems like the previous example.

Large Deductible Policies

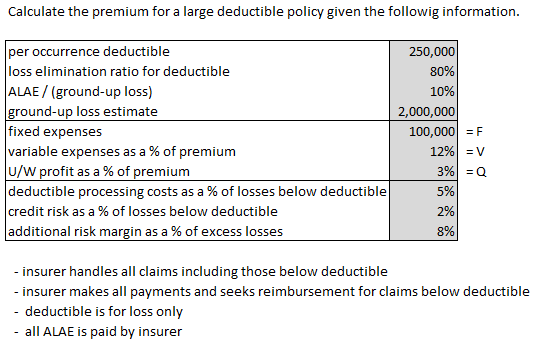

4 Large deductible policies are policies where the insured bears a significant portion of the risk. This is different from a small deductible on an auto insurance policy for example, where the purpose of the small deductible is to eliminate costs to the insurer for handling small nuisance claims.

Question: identify considerations in pricing large deductible policies (aside from "normal" considerations for small deductible policies)

- claims handling: does the insured or insurer handle claims?

- in most cases, the insurer handles all claims

- → then the premium must cover this cost and would include claims-handling costs for claims below the deductible as well

- if the insured handles claims:

- → insurer should evaluate the insured's claim handling expertise to determine the likelihood of claims leakage above the deductible

- → any material increase in costs due to insured's inexperience should be reflected in the pricing

- deductible application: does it apply to loss + ALAE or just loss?

- calculation of loss elimination ratios should be based on data consistent with the treatment of ALAE

- deductible processing:

- sometimes the insurer pays the entire claim then seeks reimbursement for the deductible

- → premium should include costs of invoicing & monitoring deductible activity

- → premium should include a provision for the risk of insured going bankrupt

- risk margin:

- losses above a large deductible are more volatile than for low-deductible policies

- → this results in greater risk and justifies a higher profit margin

Alice is going present her solution to the following exam problem on pricing large deductible policies:

- E (2013.Spring #13)

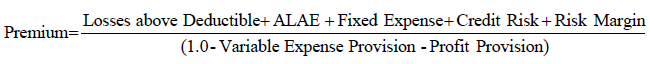

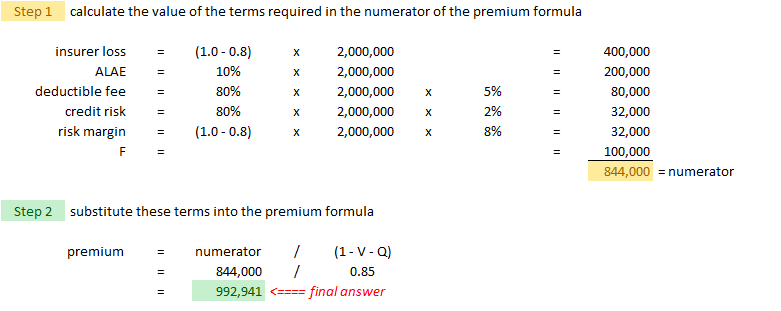

| Here's the formula you need: |

Note that the solution to the exam problem requires an extra term in the numerator of this formula. You just have to be observant and figure out how to adjust it accordingly. The extra term is the fee for handling the deductible and is based on the "deductible processing cost as a % of losses below the deductible".

| Here's the statement of the problem... |

| Here's the solution: |

Here are 2 practice problems like the previous example.

Retrospective Rating

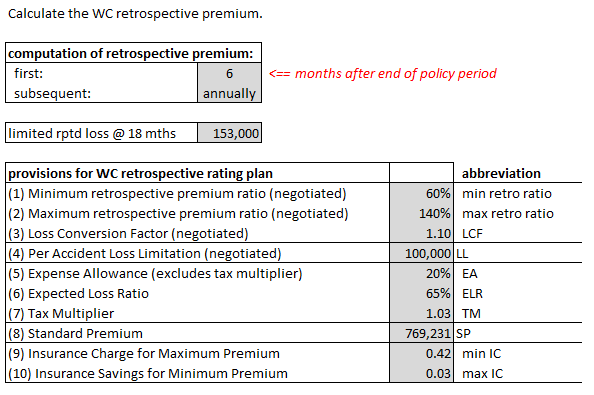

5 The main concept behind retrospective rating plans is that they use the insured's actual experience during the policy period when determining the premium for that same period. The insured is charged an initial premium but this premium is then adjusted periodically based on the insured's loss experience. This is done is such a way that both the insured and insurer retain portions of the risk in an equitable way. Some typical considerations are:

- actual losses used to determine the final retrospective premium may be capped to reduce the effect of any single unusual or catastrophic event

- total premium charged may be subject to a minimum and maximum amount (stabilizes year-to-year costs)

Here is an example from Werner for how initial premium and premium adjustments can be structured:

- The initial premium for a retrospectively rated policy may be based on the total expected expenses, profit, and costs associated with any caps. At the end of the policy period, the insured will be billed annually for all losses incurred under the policy after consideration of any capping rules contained in the policy. These adjustments will continue each year for a pre-determined length of time. The annual amount billed is referred to as a premium adjustment.

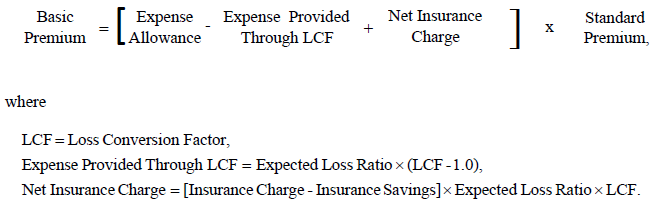

There are many terms in the formulas for calculating retrospective premium:

- Basic Premium: provides for

- - insurer's U/W profit & expenses, excluding expenses provided for by the LCF (Loss Conversion Factor) and Tax Multiplier

- - cost of limiting the retrospective premium to be between the minimum and maximum premium

- - the formula for the basic premium is the most complicated part of this problem. You'll see how this works in the example further down.

- Expenses: 3 components

- - Tax Multiplier

- - Expense Allowance

- - LCF

- Converted Losses:

- - limited reported losses adjusted for ALAE (LCF adjusts the losses to include the ALAE that is not already included in the losses plus the ULAE)

- Standard Premium:

- - premium before consideration of the retrospectively rated plan and any premium discount

- Insurance Charge/Savings:

- - the charge is the cost of limiting the retrospective premium to be no higher than the maximum retrospective premium

- - the savings is the savings for requiring the retrospective premium to be no lower than the minimum retrospective premium

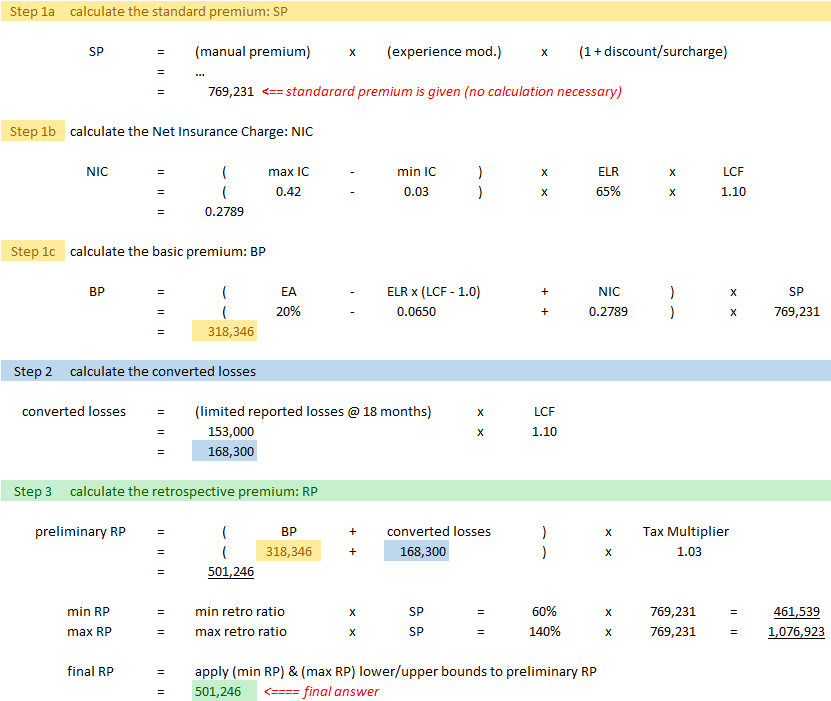

Here is Alice's version of the numerical example from Werner. There are a lot of formulas but it's very straightforward.

| Here's the problem... |

| Here's the solution... |

Here are 2 practice problems like the previous example:

Remaining Exam Problems

POP QUIZ ANSWERS

- These are among the acceptable answers to how losses can reduced without changing prices:

- → tighten U/W requirements to eliminate policies that are underpriced

- → reduce coverage levels (Ex: reduce limits or insert coverage exclusions)

- → implement better loss controls (Ex: safety programs for WC)