Werner14.Implementation

Reading: BASIC RATEMAKING, Fifth Edition, May 2016, Geoff Werner, FCAS, MAAA & Claudine Modlin, FCAS, MAAA Willis Towers Watson

Chapter 14: Implementation

Contents

- 1 Pop Quiz

- 2 Study Tips

- 3 BattleTable

- 4 In Plain English!

- 4.1 Example Imbalance

- 4.2 Non-Pricing Solutions

- 4.3 Pricing Solutions

- 4.4 Calculating New Rates for an Existing Product

- 4.4.1 Intro: The Rating Algorithm

- 4.4.2 Example A: Proposed Fixed Expense Fee

- 4.4.3 Example B: Base Rate - Easy Version (No Rate Differential Changes)

- 4.4.4 Example C: Base Rate - Extension of Exposures

- 4.4.5 Example D: Base Rate - AARD Method

- 4.4.6 Example E: Base Rate - Approximated Change in ARD Method

- 4.4.7 Example F: Other Considerations - Minimum Premium

- 4.4.8 Example G: Other Considerations - Limiting the Premium Effect of a Single Variable

- 4.4.9 Example H: Other Considerations - Premium Transition Rules

- 4.5 Calculating New Rates Based on Bureau or Competitor Rates

- 4.6 Communicating and Monitoring

- 4.7 Exam Problems

- 5 POP QUIZ ANSWERS

Pop Quiz

Do you remember the difference between a hard market and a soft market? Click for Answer

Study Tips

VIDEO: W-14 (001) Implementation → 5:00 Forum

This is a very long and difficult chapter and although it isn't ranked in the "Top 5", you really can't skip any of it. It isn't tested as often as some of the other pricing chapters but all the different problem types have been asked at one time or another. The main types of calculation problems relate to:

- expense fees

- calculating base rates

- capping territory relativities

These problems can be very messy and confusing and Ian-the-Intern was tearing his hair out trying to figure it all out. If you know any bald actuaries, this chapter on implementation is how many of them got that way. Anyway, good ol' Alice-the-Actuary redid all the text examples in a step-by-step method that should be easier to follow. She also then created similar practice problems in addition to the old exam problems so you'll get the practice you need. Remember, the key is to practice. Many of these problems seem very confusing when you first look at them but they are all within your understanding if you go slowly and methodically.

There is also a non-calculation question that seems to be asked fairly often. It's the idea of non-pricing solutions to an unbalanced Fundamental Insurance Equation. If you're really under pressure and just don't have time to slog through all the problems in this chapter, at least make sure you know the non-pricing solutions. That will only take you 10 minutes and could get you a very easy 0.5 points on the exam.

Estimated study time: 1 week (not including subsequent review time)

BattleTable

Based on past exams, the main things you need to know (in rough order of importance) are:

- base rate - calculating the appropriate base rate to be implemented with a rate change

- territorial relativities calculating territorial relativities to be implemented with a rate change

- non-pricing solutions - bringing the Fundamental Insurance Equation into balance

reference part (a) part (b) part (c) part (d) E (2018.Fall #12) PP method (adjusted)

- see Chapter 9 - Adj. PPbase rate

- calculaterating variable criteria

- see social criteriaE (2017.Fall #13) territorial relativities

- calculateE (2017.Spring #10) U/W profit

- calculatebase rate

- calculatebase rate

- evaluate mgmt suggestionE (2016.Spring #12) change in premium

- calculate averagechange in premium

- distortionnon-pricing solutions

- for inadequate ratesE (2015.Fall #9) territorial relativities

- revenue-neutral change 1territorial relativities

- evaluate impactE (2015.Fall #11) base rate (ext. of expos.)

- calculate (see here)E (2015.Spring #10) territorial relativities

- calculatenon-pricing solutions

- for inadequate ratesE (2014.Spring #10) deviation from indicated

- 3 reasonsnon-pricing solutions

- for inadequate ratesbase rate

- calculateE (2013.Fall #9) territorial relativities

- calculateE (2013.Spring #14) capping rates

- identify issuescapping rates

- reasons for

1 To solve this problem you have to make assumptions not given in the statement of the problem. You must assume that the given rating variables are the only rating variables the company uses, and that the rating algorithm is entirely multiplicative.

In Plain English!

Example Imbalance

Recall the Fundamental Insurance Equation:

- premium = (Losses + LAE + U/W Expenses) + U/W profit

If the premium on left side of the equation is projected to be $235, but the losses, expenses, and profit on right side of the equation are projected to be $250, then the equation is out of balance. The insurer would lose an average of $15 for each policy sold. Obviously that's a problem. In this chapter, we'll address that problem using both pricing and non-pricing solutions.

Non-Pricing Solutions

Non-pricing solutions attempt to reduce the costs on the right side of the Fundamental Insurance Equation. There are 4 terms on the right so that provides 3 options:

- reduce losses

- → tighten U/W requirements to eliminate policies that are underpriced

- → reduce coverage levels (Ex: reduce limits or insert coverage exclusions)

- → implement better loss controls (Ex: safety programs for WC)

- reduce LAE

- → Ex: reduce staffing levels in claims department

- reduce U/W expenses

- → Ex: reduce agent commission

You should memorize this list of non-pricing solutions. (Note that reducing the profit provision would be considered a pricing solution.)

Pricing Solutions

A pricing solution to an unbalanced Fundamental Insurance Equation is to adjust rates (versus losses or costs). In the example above, the average rate would need to be increased by $15 from $235 to $250. If this cannot be done, or if the company chooses not to do this, the U/W profit on the right side of the equation would automatically be $15 lower. Often a company may do a combination by raising rates less than the full $15, the difference being made up by a corresponding reduction in U/W profit.

Calculating New Rates for an Existing Product

Intro: The Rating Algorithm

The source text provides a list of 5 steps for calculating a final set of rates for an existing product. It probably isn't something that would be asked on the exam, but it's good to have a general idea of how it's done. I underlined the key action in each step as a memory hook. The first 3 items were covered in earlier chapters. (Note that item 2 regarding the rating algorithm is from chapter 2, which isn't on the syllabus.)

- Select an overall average premium target for the future policy period

- Finalize the structure of the rating algorithm

- Select the final rate differentials for each of the rating variables

- Calculate proposed fixed expense fees and other dollar additives, if applicable ← major topic in this chapter

- Derive the base rate necessary to achieve the overall average premium target ← major topic in this chapter

The examples in this chapter use the following example rating algorithm:

Rating Algorithm (average premium): Pp = [ Bp x R1p x R2p x (1.0 – D1p – D2p) ] + Ap

where

- Pp = average premium per exposure

- Bp = base rate (proposed)

- R1p, R2p = relativities for rating variables 1 & 2 (proposed)

- D1p, D2p = discounts (proposed)

- Ap = additive expense fee (proposed)

As an incredibly simple example for Ian-the-Intern, let's use this formula to calculate the average premium given the following:

- Bp = $500

- R1p = 1.1, R2p = 1.15

- D1p = 10%, D2p = 5%

- Ap = $25

Simple substitution yields Pp = $562.63. If this were auto insurance, the discounts might have been something like 10% for airbags, and 5% for an anti-theft security system.

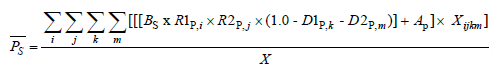

There is a slightly different version of the rating algorithm that's also used in this chapter. Recall that Pp = Pp / X so if you multiply both sides of the formula by exposures X, you get:

Rating Algorithm (TOTAL premium): Pp = [ [ Bp x R1p x R2p x (1.0 – D1p – D2p) ] + Ap ] x X

We will use this formula for total premium with the extension of exposures method for calculating a proposed base rate. If you check the source text, you'll see that their rating algorithm is written a little differently. Their formula looks more complicated because they included all of the subscripts. Strictly speaking, the subscripts should be there but I found it unnecessarily confusing to type them out every time. Let's just agree the subscripts are there even if they aren't specifically written. Very quickly, here's the text version:

If R1 (Rating Variable 1) has 3 different levels then i can take on the values 1,2, or 3. If R2 has 4 different levels, then j can take on the values 1,2,3 or 4. Same idea for the discounts D1 and D2 using the indices k and m. Note that "l", which is a small "el", is not used. This is to avoid confusion because it looks too much like the numeral "1".

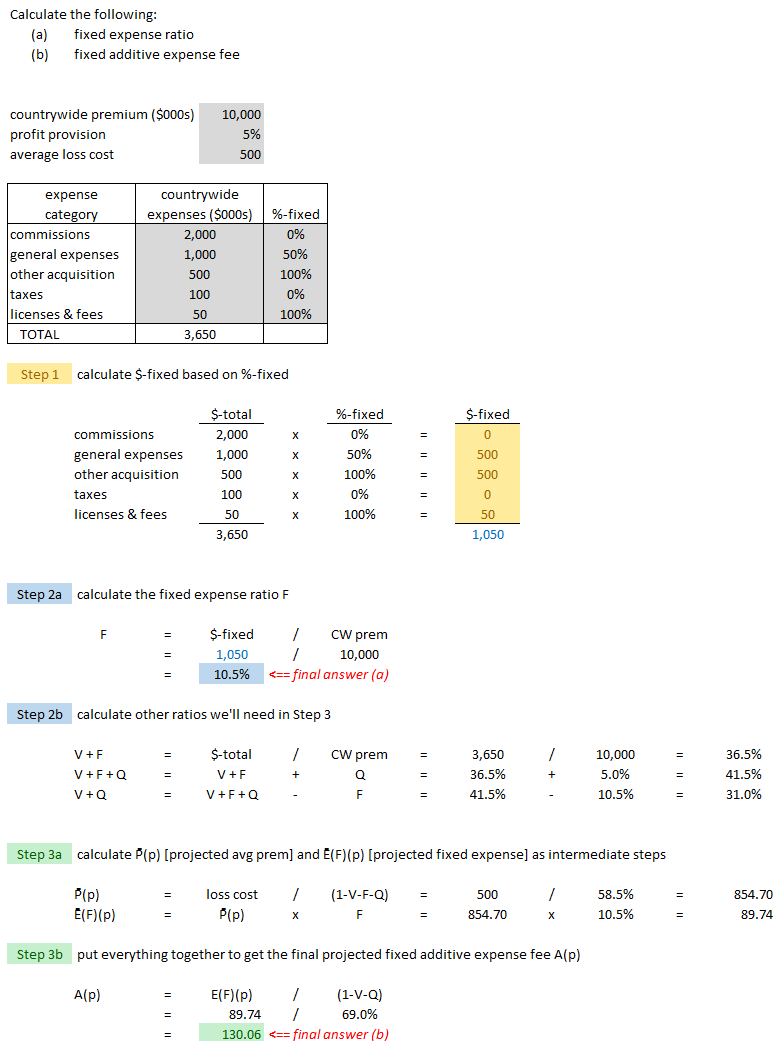

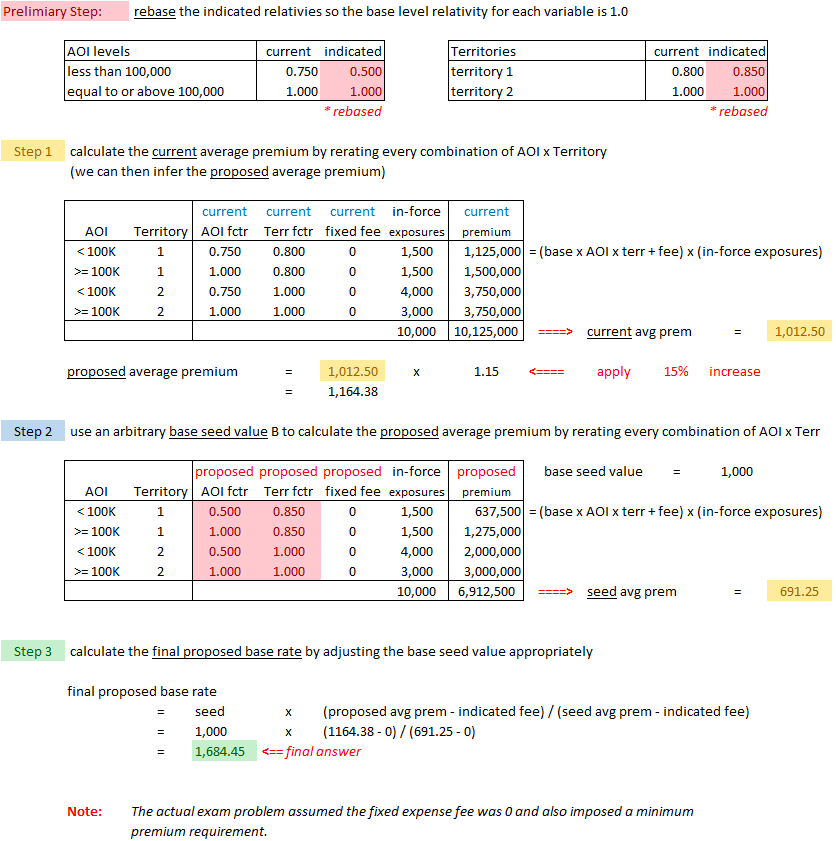

Example A: Proposed Fixed Expense Fee

We're going to build to a more general example than the one presented in the text. First we need a couple of definitions:

definition: the variable premium is the portion of the total premium that varies by risk characteristics

definition: the additive premium is the portion of the total premium derived from expense fees and other dollar additives

- * Additive premium is the same thing as flat premium.

Our rating algorithm incorporates fixed expenses through an additive per exposure expense fee Ap. How do we calculate this additive fee? The first example in Werner is super-simple and demonstrates the concept. Suppose we're given:

- EF = average fixed expense per exposure = $20

- V = variable expense provision = 15.0%

- QT = target profit percentage = 5.0%

Then the premium we need to charge to cover this is:

- EF / (1 - V - QT) = $20 / (1 - 15.0% - 5.0%) = $20 / 0.8 = $25

This is the same adjustment as in chapters 7 and 8 when we adjusted the total loss cost to derive the average premium charged. Click to review the Pure Premium Formula. Recall also that the denominator (1-V-Q) is called the Variable Permissible Loss Ratio or VPLR.

The second example in Werner is almost as simple but instead of giving you EF directly, they provide:

- F = fixed expense ratio = 8.0%

- Pp = projected average premium per exposure = $250

So you have to calculate EF yourself:

- EF = F x Pp = 8.0% x $250 = $20.

That gets you back to the starting point for the first example.

| Here is a more realistic version of this type of problem: |

| And here are a couple of practice problems just like the example above... |

Practice: 2 Fixed Expense Fee problems

Example B: Base Rate - Easy Version (No Rate Differential Changes)

Recall the 5 steps from the Intro for calculating a final set of rates for an existing product. The last step is:

- derive the base rate necessary to achieve the overall average premium target

We're going to look at several examples of how to do this starting with an easy example. First recall the rating algorithm as shown below. Having this formula (using either the subscript "p" for proposed premium or the subscript "c" for current premium) will make it clear what's happening algebraically:

- Pp = [ Bp x R1p x R2p x (1.0 – D1p – D2p) ] + Ap

Of course, this formula also holds for current rates:

- Pc = [ Bc x R1c x R2c x (1.0 – D1c – D2c) ] + Ac

Scenario B1: Assume we know Bc and Pc. We want to calculate the proposed base rate Bp that will achieve the proposed premium Pp. For this very simple scenario, we also make these assumptions:

- all premium is variable

- → Ap = Ac = 0

- rate differentials are not changing

- → R1p = R1c

- → R2p = R2c

- → D1p = D1c

- → D2p = D2c

If you substitute into the equations for Pp and Pc, cancel terms, then solve for Bp, you get:

Bp = Bc x (Pp / Pc)

This is so simple, you can just make up your own example. All that's happening is that the current base rate Bc is being increased by the same proportion as the desired increase in average premium.

Scenario B2: Same as scenario B1 except we allow the fixed expense fees Ap and Ac to be non-zero. If you again start with the above formulas for Pp and Pc then simple algebra yields:

Bp = Bc x (Pp – Ap) / (Pc – Ac)

As an example, suppose a 3.0% overall change is desired. One way of doing this is to increase both the base rate and fixed expense fee by 3.0%. But if you want to keep the (non-zero) fixed expense at the same level, the base rate increase would have to be greater than 3.0% to compensate. For example, if:

- Pc = 400

- Pp = 400 x 1.03 = 412

- Bc = 300

- Ap = Ac = 20

then

- Bp = 300 x (412 - 20) / (400 - 20) = 309.47

which is a 3.16% increase in the base rate.

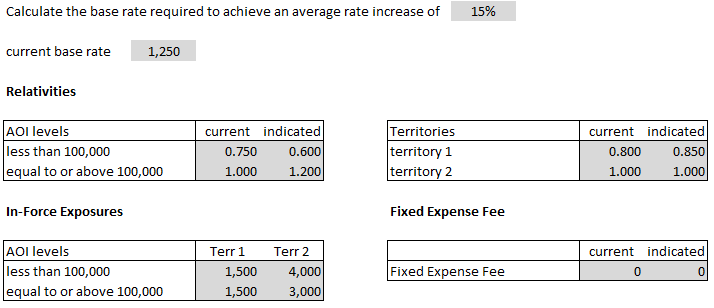

Example C: Base Rate - Extension of Exposures

Examples C, D, E show how to calculate the new base rate when relativities are changing. Example C uses the extension of exposures method which is the most accurate because it rerates individual policies. The disadvantage is of course that it requires detailed policy level detail and that may not be readily available.

The example of the extension of exposures method from the source text is okay but it's presented in a way that makes it seem a lot more complicated than it really is. It starts on page 268 and you can take a look at it if you want but I decided to focus more on an old exam problem that uses this method. Unfortunately the examiner's report solution isn't very clear so I asked Alice solve it in Excel using her usual step-by-step method. Anyway, if you do decide to look at the text example, here's a warning:

Warning! If you look at the source text, don't let the formulas with the quadruple summations throw you. Think of if this way:

- The formula inside the summation is the rating algorithm and represents the total premium for one particular combination of rating variables and discounts.

- The entire right side of the formula represents the average premium for all combinations of rating variables and discounts.

- → There are 2 rating variables and 2 discounts.

- → That's why there are 2+2 = 4 levels of summation. (This is different from the total number of combinations of rating variables and discounts.)

- (If there had been 3 rating variables and 2 discounts then there would be 3+2 = 5 levels of summation.)

- (And if all 3 rating variables had 4 levels, plus a binary yes/no for each of 2 discounts, there would be (4x4x4)x(2x2) = 256 combinations of rating variables.)

We're going to look at the 2015.Fall #11 exam problem. The extension of exposures method isn't asked very often, but this question was worth 4 points. (That's a lot of points considering the Exam 5 syllabus says all of Werner Chapter 14 only accounts for 0-3% of the exam.)

- E (2015.Fall #11)

The extension of exposures method is kind of a strange method. Here's the question along with the given information. We'll talk through it in general a little bit before presenting the detailed solution, but the only way to really get it into your head is to practice it.

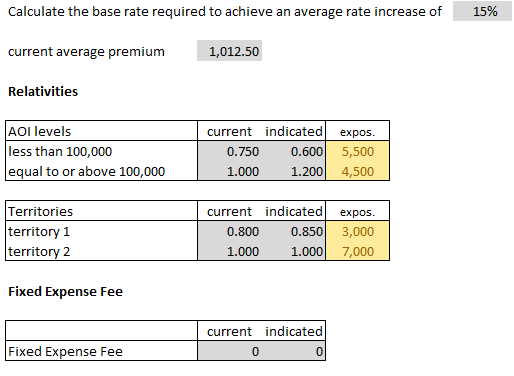

Comments on Alice's solution: (solution is below comments)

- You're told that the average rate should increase by 15%, but you're not given the average rate. To find the current average rate you use extension of exposures, which means to rerate every combination of rating variables. (There are only 2 rating variables and no discounts in this problem.) This is step 1 in Alice's solution below. Once you have the current average rate of $1,012.50, just add 15% to get the proposed average rate of $1,164.38.

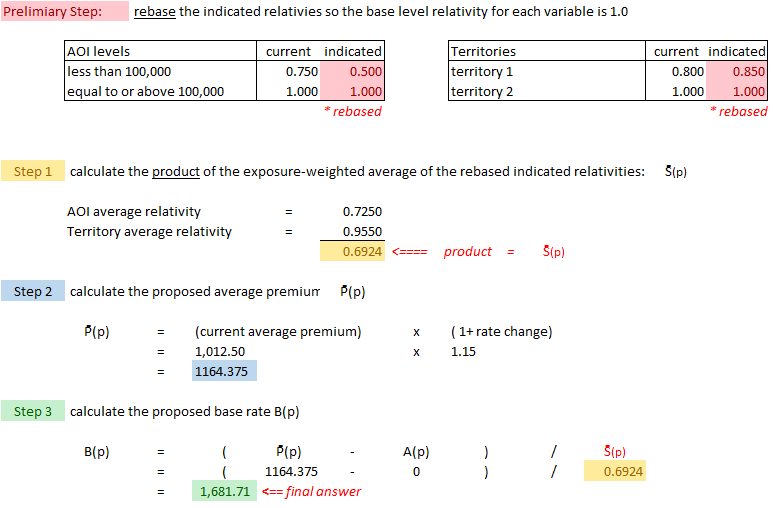

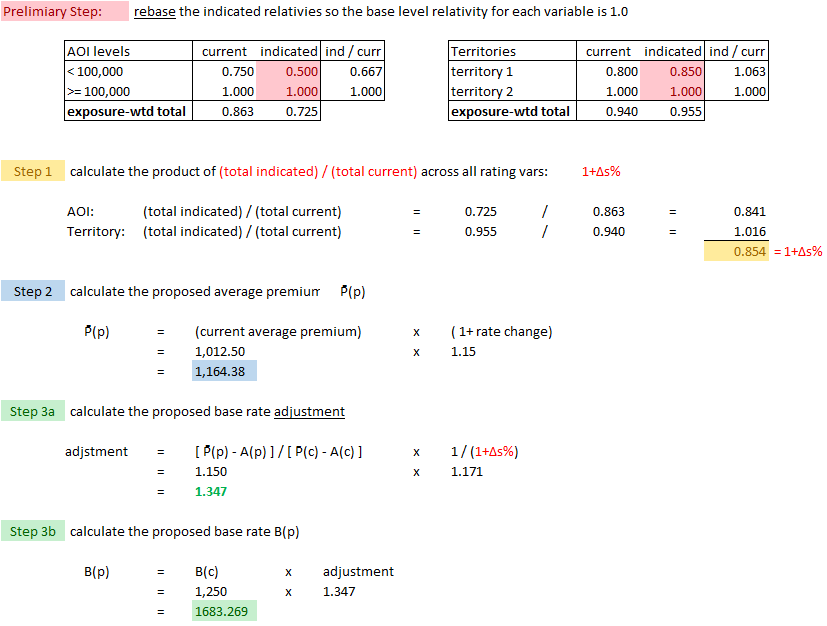

- Notice the very sneaky preliminary step of rebasing the proposed relativities. This didn't matter for step 1 because we only needed the current relativities. You will need the rebased proposed relativities in step 2 however or your final answer might be a teensy bit wrong. :-(

- Okay, step 2 is where it gets a bit weird. Remember you're trying to find the proposed base rate, so what do you do? Well, you guess! You just make up any old number then test it to see if it works. This guess for the proposed base rate is called the seed. Alice used $1,000 in her solution. You then use this seed value along with the indicated relativities to calculate the average proposed premium based on this seed. Of course unless you're very lucky, it's not going to be correct. Alice got a "seed" average rate of $691.25, too low, because we're aiming for $1,164.38. You could try another seed, (somewhat higher than $1,000), to see if you get closer but trial and error is a slow way to get the answer.

- Instead of trial and error, you can simply adjust your original guess of $1,000 by an proportionate amount. This is step 3.

- Side comment 1: Something I didn't quite believe when I first read this chapter is that the method will work regardless of what you choose for your seed value. You can use absolutely any random number. You should try it in the Excel spreadsheet. But since it doesn't matter, I always just choose 1.0. Then the seed value just drops out of the calculation entirely. I'm not really sure the concept of seed value is even necessary, but that's the way the text does it so you should probably understand it.

- Side comment 2: The formula used in step 3 uses the proposed fixed expense fee in both the numerator and denominator. At first, I thought this was a misprint in the text but then I realized it's correct because the adjustment is not from the current base rate to the proposed base rate. The adjustment in step 3 is from the seed base rate to the proposed base rate and both the seed and proposed rates use the proposed fixed expense fee. (The current fixed expense fee was used in Step 1 when calculating the current premium.)

Alice's solution:

And here are a couple of practice problems like the above example:

Example D: Base Rate - AARD Method

When I read this section in the source text and saw all those complicated formulas, I was like, huh? Then Alice gave me some advice. :-)

Alice's Pro Tip: The AARD method is easy if you follow her awesome explanation below (even though the text makes it seem mind-numbingly complicated.)

As discussed in the previous section, the extension of exposures method is very accurate but not always feasible because of the detailed data it requires. The AARD method or Approximated Average Rate Differential method is an alternative, but before getting into it I'd like to do a quick review and also mention something I found helpful while reading this chapter. You should keep the goal firmly in mind:

- goal: calculate the proposed base rate Bp

In examples B1 and B2, we had 2 versions of a formula for Bp:

- from Example B1: Bp = Bc x (Pp / Pc)

- from Example B2: Bp = Bc x (Pp – Ap) / (Pc – Ac)

Example B1 assumed all expenses were variable so a term for fixed expenses wasn't needed. Example B2 did not make the "all variable" assumption. But both B1 and B2 assumed no changes in rate differentials (relativities.)

Example C, which used extension of exposures did allow for changes in rate differentials, and Example D, discussed below, also allows for this. Here's the thing I want to mention: If we temporarily ignore fixed expenses, then the following 3 quantities must balance:

- overall change

- base rate change

- relativity change

If you put these into an equation, you get:

(overall change) = (base rate change) x (relativity change)

If you think about it for a moment, it's obvious. It follows from the (purely multiplicative) version of the rating algorithm, that is, the version where the fixed expenses are 0. Of course, we can't in general assume that fixed expenses are 0, but I found it helpful to keep in mind this idea of the base rate change and relativity change balancing each other. For a particular overall change, if the base rate change is higher, then the relativity change must be lower, and vice versa. And if you know 2 of these changes, you can calculate the third. That's what this section boils down to. You're typically given the overall change and the relativity changes, then have to calculate the proposed base rate. And a similar way to think about it using premium is:

(proposed premium) = (current premium) x (base rate change) x (relativity change)

It gets slightly messier when you insert fixed expenses but this is the basic idea. Remember this if you find yourself getting confused with all the different formulas and symbols.

Okay, I dunno if all that junk above is helpful to you, but thinking through it like that helped me make more sense of it. If you look at the source text for this section, there is a lot more there than you need to know. If this were a math course where you had to do proofs then you would have to understand it, but that's not the goal here. You only need to learn how to do the calculation, and as Alice said above in her pro-tip, it's actually quite easy. The key concept is Sp:

Sp = weighted average of indicated relativities across all rating variables

Then you calculate the proposed base rate Bp using this simple formula:

Bp = (Pp – Ap) / Sp

But if you could calculate Sp precisely, then you could use the extension of exposures method. So the AARD method is used in situations where you can't do that. In this case,

approximation to Sp = the product of exposure-weighted averages of rebased indicated relativities across all rating variables

I think of the true Sp as a multivariate calculation but the approximation to Sp as the product of univariate calculations.

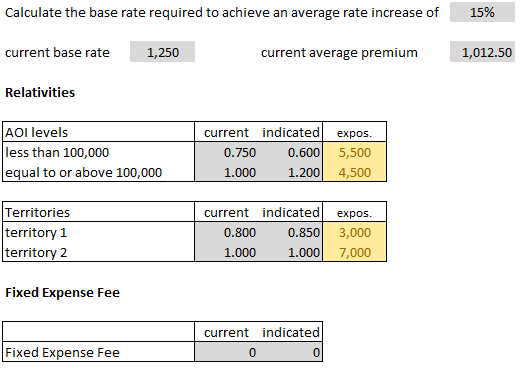

So finally here is Alice's example of AARD using the same numbers from Example C, except that you don't have the same level of detail for the exposure data so you can only get an approximation of Sp.

And here's the solution:

And a couple of practice problems:

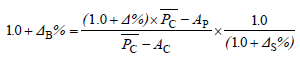

Example E: Base Rate - Approximated Change in ARD Method

With the AARD method of the previous section, you needed the weighted average relativities for all rating variables. In contrast, for the A(Δ)ARD method, pronounced A-Delta-A-R-D, you only need to calculate weighted averages for rating variables where relativities are changing. This saves time. For example, if you have 8 rating variables but only 2 have relativity changes then A(Δ)ARD requires only 2 weighted average calculations (versus 8 for AARD.) Note that for this to work, the variable premium portion of the rating algorithm must be entirely multiplicative, as is the case for the examples in this chapter.

The source text shows the derivation of the A(Δ)ARD formula. You can look at it if you want, but we're going to skip ahead to final result, which is what you have to know for the exam:

Once you've calculated the right side of this equation, you multiply the result by the current base rate Bc to get the new base rate Bp. This is all demonstrated in the example below, but here are a couple comments before you look at it:

- The quantity (1 + Δ%) x Pc equals Pp. I'm not sure why they didn't just leave that term as Pp as it seems simpler.

- The quantity (1 + Δs%) is new to the A(Δ)ARD method and is an approximation to the overall change in relativities across all rating variables. You cannot calculate the overall change exactly with the information given. If you did have sufficient information for an exact calculation, you would have enough information to apply the extension of exposures method. Recall, the extension of exposures gives exactly the correct answer so you would then use that instead.

- The second factor on the right side of the equation is called the off-balance factor. It's the adjustment to the base rate that's required to balance the changes in relativities. Recall the relationship:

- (overall change) = (base rate change) x (relativity change)

Anyway, that's enough jibber-jabber. Here's an example.

And here's the solution.

And a couple of practice problems.

Example F: Other Considerations - Minimum Premium

This is extremely simple. Suppose an insurer has 10 policies and uses its multiplicative rating algorithm to price those policies as follows:

- 9 policies are priced at $500

- 1 policy is priced at $200

The total premium is then $4,700. Suppose the insurer has also set a minimum price of $300 per policy to make sure that fixed expenses plus some minimum expected loss are covered. Then the price of the $200 policy gets raised to $300 and the total premium increases from $4,700 to $4,800. The effect of the minimum premium is:

- $4,800 / $4,700 - 1.0 = 2.13%

In general:

effect of minimum premium = (premium WITH minimum) / (premium WITHOUT minimum) – 1.0

A minimum premium will always increase the total premium. But if the insurer wants to maintain a targeted level of proposed premium, they would have to reduce the premium on all the other policies by just a little bit. For our example, the $100 increase on the 10th policy would have to be distributed across the other 9. Instead of charging $500 for those other 9 policies, the insurer would charge only:

- $500 - $100/9 = $488.89

This is accomplished within the rating algorithm by adjusting the base rate downward by this offset factor:

- 1.0 / (1.0 + 2.13%) = 0.9791

The new premiums would then be:

- $4,500 x 0.9791 = $4,406 for first 9 policies

- $200 x 0.9791 = $196 for the 10th policy

Because of the minimum premium requirement, this 10th policy would be increased to $300 so the total premium for all 10 policies is now:

- $4,406 + $300 = $4,706.

This is actually a little too high. This offset factor doesn't quite work but it's the formula given in the text and I guess it's close enough.

In general:

offset factor = 1.0 / (1.0 + effect)

The text doesn't provide an example but once you've read through my example above you'll remember how it works. Just take a moment to memorize the 2 formulas.

Example G: Other Considerations - Limiting the Premium Effect of a Single Variable

Before we get into the calculations, Alice pointed out something sneaky from Werner & Modlin that I hadn't noticed.

Something sneaky... The examples in this section use premiums whereas the examples from all the previous sections in the chapter used exposures.

Ok, why the change? Here is Alice's 2-part answer:

- Premiums at current rate level for individual levels of rating variables might be hard to get, especially if the rating algorithm is not entirely multiplicative. It's just easier to get exposures at that level of detail. That's why we used exposures previously.

- But when limiting the premium effect of a single variable as we're doing here, we must have premiums because the method depends specifically on making adjustments to premium impacts.

The text didn't mention this switch from exposures to premiums. (The text did mention in an earlier section however that it's actually more accurate to use premiums rather than exposures for weighting the relativities. If the premiums were easier to get then we would have used them everywhere.)

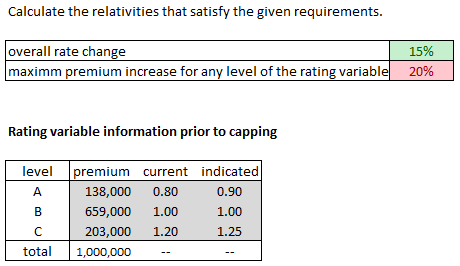

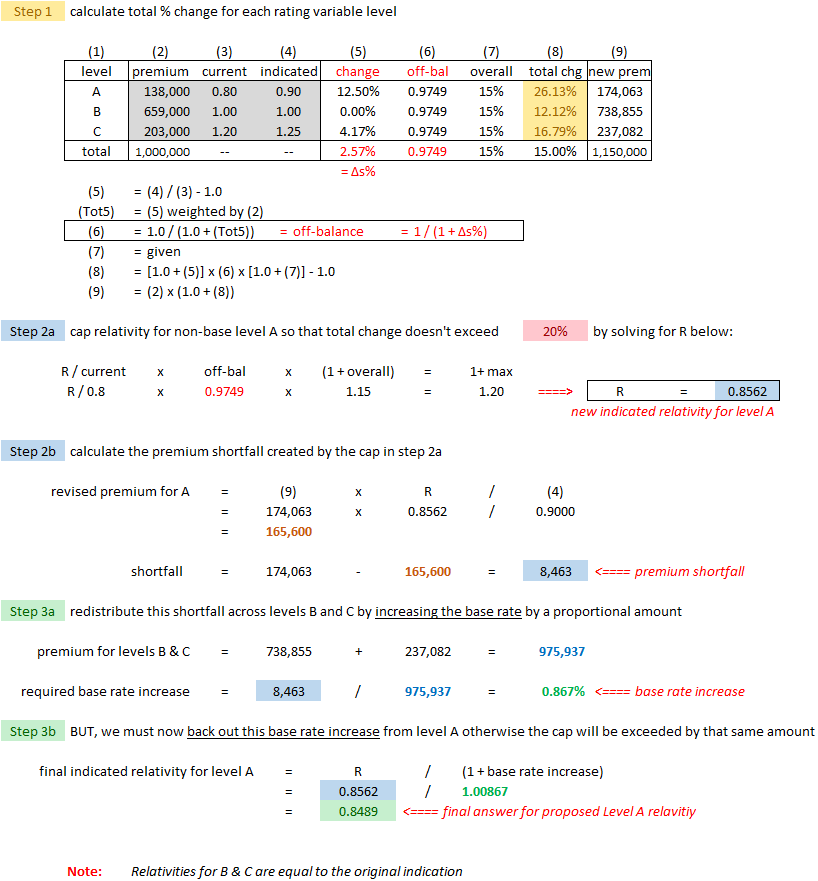

Example G1: Capping the Non-Base Level

Here is a typical example of this type of problem: (It's the example from the text but reorganized into a step-by-step method.)

If you want, you can skip ahead to the solution but Alice wanted to make a few comments to help you figure out better what's going on:

- We want an overall average rate change of 15%. Of course if this is the average, then certain segments of the book of business will get less than a 15% increase while other segments will get more than 15%.

- This is potentially a problem if we want to limit any segments to a maximum increase, say 20%. It turns out that with the relativity changes given above, level A of the rating variable will end up with a 26.13% increase.

- The way to fix this is to take some of that extra 6.13% and distribute it to levels B & C. Levels B & C were well below the 20% threshold at ~12% & ~17% so there is room for those segments to have more of an increase.

- So this is what actually happens:

- → The indicated relativity for Level A of 0.90 is capped at a lower amount in such a way as to keep the increase to 20%. The capped value turns out to be 0.8562

- → The leftover 6.13% is distributed to Levels B & C by increasing the base rate (The base rate is not actually given in this problem, but you can still figure out how much it has to increase.)

- → But there's 1 final complication (of course!) Increasing the base rate will increase the %-change for B & C but also A. So if you stopped here, the change for Level A would increase due to the base rate increase, which we don't want. The final step is to back out this base rate increase from the capped Level A relativity of 0.8562. You end up with 0.8486 and then everything works.

Okay, here's the step-by-step solution followed by a couple of similar practice problems:

And a couple of practice problems for you enjoyment. :-)

Here is a closely related exam problem but note that to solve it you have to make assumptions not given in the statement of the problem. You must assume that the given rating variables are the only rating variables the company uses, and that the rating algorithm is entirely multiplicative.

- E (2015.Fall #9)

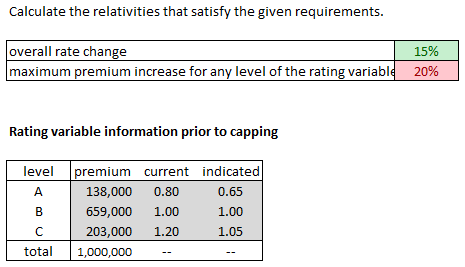

Example G2: Capping the Base Level

This morning Alice found Ian-the-Intern in the break room weeping gently over his morning coffee. She asked him what was wrong. "It feels like this chapter is never going end," he said. Alice felt so bad for him that she gave him her chocolate chip cookie. :-)

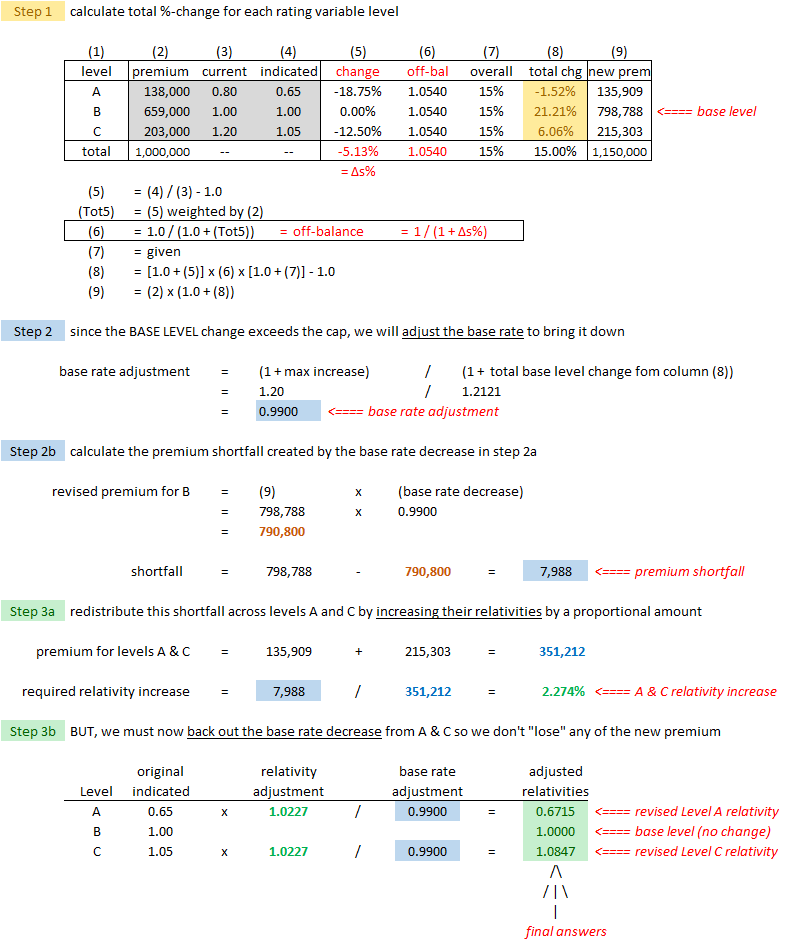

There's just 1 more calculation problem to cover in chapter 14. Notice that the capping we did in the previous section was for the case where the non-base level exceeded the cap. Unfortunately, the procedure is a little different when it's the base level that exceeds the cap. We don't need to start completely from scratch however. Step 1 is the same. Steps 2 and 3 are a little different but if you understand the previous example, you'll get through this one more quickly. Just follow the steps.

Alice's numbers are slightly different from the text due to rounding. (The text rounded the intermediate steps and Alice didn't.)

And some practice problems...

Example H: Other Considerations - Premium Transition Rules

This is another very simple section and text example is trivial. :-)

In the, previous section we looked at capping the %-change for individual levels of a rating variable. It's still possible however that the rate change for individual insureds can be large. (This may be due to the cumulative effect of changes for several rating variables.) A large increase may induce an insured to shop around for lower prices, which the insurer usually wants to avoid. A way around this problem is to implement premium transition rules.

Premium Transition Rule: a rule that dictates the maximum and/or minimum amount of change in premium that an insured can receive at a single renewal

For example, suppose the proposed rate for a customer is 30% higher than their current rate but the transition rule specifies a maximum increase of 20%. A transition rule would limit the current renewal to 20% then take the remaining 130%/120% - 1.0 = 8.3% on the next renewal.

Here's a bullet point list from the text which is a favorite type of exam question, especially in Exam 6. I kind of doubt this would appear on the exam, but once you read it, it's common sense.

Question: identify 4 considerations when using a premium transition rule

- determine maximum and minimum allowable changes

- determine length of transition period

- apply transition rule only to premium changes resulting from company-initiated rate changes (not changes in insured's risk characteristics)

- effect on average premium (if maximums are applied then expected average premium will decrease)

In general, shorter transition periods are preferable so that multiple transition periods don't overlap. Note that if an insured got a large rate increase because of a bunch of speeding tickets, that type of increase would not be subject to a maximum. That's the type of customer an insurer might want to get rid of anyway.

Also, a decrease in average premium resulting from imposing maximums can be "corrected" by increasing base rates. In other words, subsidize the insured who would have received the large change by charging everyone else just a little more. (Strictly speaking, this violates principle 3 of the Standards of Practice on ratemaking but it's done anyway.)

An implicit assumption in this chapter is that any rate changes will not alter the existing portfolio. (This is why we used the in-force distribution to calculate proposed average premium.) If the rate change is small, this assumption may be valid. If the rate change is large, especially if the change is not uniform across all insureds, there will very likely be a distributional change. In particular, those insureds receiving large increases will be more likely to shop around to other insurers for cheaper coverage. Note however that if every policy were equally profitable then losing or gaining customers would not affect rate adequacy even if the distribution changes.

Calculating New Rates Based on Bureau or Competitor Rates

When an insurer introduces a new product, they won't have internal data from which to calculate rates. The insurer may then decide to use bureau or competitor rates as a starting point. For competitor rates, you would at least need their rating manual but it would also be useful to have a sense for their relative expense levels and profitability. There are 4 adjustments an insurer may want to make to competitor rates before implementation:

- adjust fixed expenses up or down by an appropriate percentage

- adjust variable expenses up or down by an appropriate percentage

- adjust loss costs up or down by an appropriate percentage

- adjust rate differentials up or down by an appropriate percentage (possibly with the intent to target a market under-served by the competitor)

Note that an insurer would not have access to the competitor's underwriting guidelines which is a big missing piece. For this reason, it's wise for an insurer to build the new business gradually until such time as they have sufficient credible data of their own.

Communicating and Monitoring

Proposed rates should be communicated to stakeholders such as regulators and company management. Communications should include assumptions underlying the selections of items such as trends and rate differentials. It is helpful to provide projections on volume, profitability, and also possibly on other metrics such as conversion and retention ratios.

After rates have been implemented, results should be monitored and compared to original projections. Monitoring emerging experience can identify unexpected differences and thus gives management an opportunity to take corrective action.

Exam Problems

Problems on calculating a base rate...

Problems on calculating territorial relativities...

Miscellaneous problems...

POP QUIZ ANSWERS

- A hard market means high prices. (A soft market means low prices)